This post adds to previous posts about the Unsustainably Rent Burdened population. These posts while initially focused on the URB households have offered more general insights about the rent-burdened population — namely that it is smaller and more middle-income than commonly reported. In this post, we add an additional lens: The HUD Public Use Microdata Sample. The HUD PUMS allows us to make some observations that tend to confirm our previous analysis.

The HUD MicroData

The HUD PUMS is a national sample including 5% of all tenant households in the major HUD housing programs listed below. All charts in this post will use the abbreviations noted for these programs.

- “P” — Public Housing (federal as opposed to state, but run through local housing authorities)

- “Sec 8” — Project Based Section 8 (apartment buildings with rental assistance contracts)

- “Sec 202” — Section 202 (Federal Supportive Housing for the Elderly)

- “Sec 811” — Section 811 (Federal Supportive Housing for Persons with Disabilities)

- “V” — Housing Choice Vouchers

Together, the first four programs above constitute over 63% of the “rent-based-on-income” housing units in Massachusetts (with the balance coming from state public housing and tax credit units that have project-based vouchers attached). See this previous post for more on each of these programs. The fifth program above, the federal Housing Choice Voucher program, provides approximately 90% of the mobile vouchers available in Massachusetts.

The PUMS file includes a state identifier. However, the released data is fully anonymized. Sampled tenants whose data is so unique that confidential information could be disclosed if their state were identified are assigned a “Missing” state code. Approximately 20% of households are assigned the missing code. The total program counts in the 2023 data for Massachusetts are low by percentages roughly consistent with the missing values.

The data items provided for the sampled households include ranges for both household income and adjusted household income. For program administration purposes, income (inclusively defined) is adjusted by excluding amounts for dependents, medical costs, etc. These adjustments may reduce a household’s income to zero. Rent is calculated by administrators as the larger of 30% of adjusted income or 10% of unadjusted income or a minimum amount set by the housing authority. However, hardship waivers are permitted and anecdotally, these are frequently granted.

The sample data items do not include rent paid per se, but include a computation of “rent burden” as follows:

Rent burden is defined as gross rent (including utility costs) divided by monthly adjusted household income. Rent burden is undefined for households with $0 adjusted income. Rent burden is measured by character variable “brdn”. Rent burden is reported in four categories: 0%-31%, 32%-39%, 40%-49%, and 50% and above.

HUD PUMS Data Dictionary (emphasis added)

In all of the tables below, the data:

- Are based on the 2023 HUD Microdata Sample

- Cover only Massachusetts

- Present weighted totals based on sample weighting.

- Reflect households (Weighted N=151,971 in Massachusetts) as opposed to individuals.

Observation One: There is a zero income, likely zero rent, cohort in the HUD programs.

The table below isolates the share of the population for which rent burden is undefined — a total of 9,018 households across all programs. The only reason offered in the documentation for rent burden being undefined is adjusted income being zero. It is possible that in some cases rent is being suppressed to protect confidentiality; however, the documentation does not identify this variable as subject to suppression (while it does so identify a number of other variables).

Table 1

| Program Abbreviation | Rent Burden Computed | Rent Burden Undefined | Total in Massachusetts Sample | % Not Computed |

|---|---|---|---|---|

| P | 22,398 | 426 | 22,824 | 2% |

| Sec 202 | 3,130 | 23 | 3,153 | 1% |

| Sec 8 | 47,609 | 913 | 48,522 | 2% |

| Sec 811 | 577 | 72 | 649 | 11% |

| V | 69,239 | 7,584 | 76,823 | 10% |

| 142,953 | 9,018 | 151,971 | 6% |

Roughly consistent with the previous chart, the chart below shows adjusted income in ranges across all programs. The low range count, 8,504, is close to but a little below the “rent burden undefined” count above, suggesting that at least a few households have rent burden missing or suppressed for a reason other than having zero adjusted income. Additionally, of course, not all in the lowest range have zero income.

Table 2

| Adjusted Income Range | Count in Massachusetts Sample | % in Massachusetts Sample |

|---|---|---|

| $0-$2,500 | 8,504 | 6% |

| $2,501-$5,000 | 3,706 | 2% |

| $5,001-$7,500 | 3,797 | 2% |

| $7,501-$10,000 | 7,083 | 5% |

| $10,001-$12,500 | 41,747 | 27% |

| $12,501-$15,000 | 11,689 | 8% |

| $15,001-$17,500 | 11,107 | 7% |

| $17,501-$20,000 | 11,359 | 7% |

| $20,001-$25,000 | 14,481 | 10% |

| $25,001-$30,000 | 9,013 | 6% |

| $30,001-$40,000 | 11,903 | 8% |

| $40,001-$90,000 | 17,582 | 12% |

| All Income Ranges | 151,971 | 100% |

If as many as 8,000 households in this sample have zero adjusted income, and we inflate that rough ceiling as in the attached spreadsheet (a) to reflect that the sample of federal units is incomplete and (b) to add state units (managed by the same housing authorities), it appears that as many as thirteen thousand households in subsidized units have zero as adjusted income. Of these, as the attached spreadsheet shows, over 60% were in the lowest income range before adjustment.

Within the population of households in subsidized housing with zero adjusted income, many have whom had zero unadjusted income, it is likely that a sizeable share are paying zero rent. The order of magnitude of this possible population does correspond with the Extremely Low Income population paying no rent in the American Community Survey data — 14,194. In previous discussion, we reached no conclusion as to how to characterize the no rent households. However, the data here, while not definitive, lend plausibility to the hypothesis that the ACS no-rent-Extremely-Low-Income population are to a material extent in subsidized housing as opposed to, for example, living in housing gifted from a family landlord. Note, however, that in the no-rent-ELI set of households in the ACS, 38% report no means-tested-program participation (Mass Health, Food Stamps, Public Assistance or SSI) — so they may not be eligible for housing subsidy either.

Observation Two: Very few tenant households in HUD programs have rent burdens over 30%.

Using the rent burden field from the HUD data, we have the following:

| Rent as % of Adjusted Income | Households | % of Households |

|---|---|---|

| No income/rent? | 9,018 | 6% |

| 0%-31% | 136,174 | 90% |

| 32%-39% | 4,051 | 3% |

| 40%-49% | 1,250 | 1% |

| 50% and above | 1,479 | 1% |

| Total in Massachusetts Sample | 151,971 | 100% |

Only 5% have rent burden over 31% and only 1% have rent burden of 50% or over. This sample represents federally supported households. It seems unlikely that the smaller state-supported universe is very different since it is managed by the same housing authorities and state rules require gross rents to be set at 30% or 32% of income. It is safe to infer that very few households in supported state or federal housing are rent-burdened. This is common sense and reflects our understanding of the practices of housing authorities in Massachusetts, but this data set offers confirmation. Note that rent burden here is presented here based on adjusted income; unadjusted income is generally higher, so using unadjusted income would result in lower rent burdens.

Altogether, we know that there are a total of approximately 230,000 housing units that either rent-based-on-income or are occupied by tenants with mobile vouchers. (For details see this post and this post. Note that this count excludes another 60,000 units that rent at fixed rates below market which we omit entirely from this analysis. ) From the HUD Picture of Subsidized Households we know that roughly 79% of the federal households are below the Extremely Low Income level and almost all are below the VLI level. Even allowing a somewhat higher income mix in state funded housing (this is a modest uncertainty), it follows that approximately 175,000 Extremely Low Income households in Massachusetts are not rent burdened. This constitutes roughly 55% of ELI households. Contrary reporting based on the American Community Survey — to the effect that an overwhelming majority of ELI households are rent burdened — is driven by noise in both rent and income reporting to the ACS. Our analysis pertains to Massachusetts, but the data set is national, and as shown in the attached spreadsheet, rent burden rates are very low in federally supported housing nationally.

Connecting the Dots

In the last post in this series, we offered an approach to identifying the rent-based-on-income housing units in the American Community Survey: Namely, we suggested that they are cognate with the set of units that have the lowest reported rents (subject to wrinkles about voucher holding households). We acknowledged that the analysis involved conceptual uncertainties. The data reviewed here help to resolve some of the uncertainties in the direction of supporting the previous finding.

- The data lend support to they hypothesis that some share of the free rent tenants in the ACS are in subsidized housing. This has the effect of lowering the rent threshold needed to include enough low rent units to cover the RBI set (since some of the RBI units are accounted for within the zero rent group).

- Indirectly, the data suggest that low-rent units are less likely to be low-rent due to personal/familial subsidies — this is a soft inference from the finding that the no-rent units may not be no-rent due primarily to personal/familial subsidies. This finding also has effect of lowering the rent threshold needed to have enough low rent units to cover the RBI set. (Or, more correctly stated, the finding operates to reduce the plausibility of a factor that might raise the threshold).

- Lowering the rent threshold means that fewer higher income households are captured, improving the hypothesized congruence between the low rent set and the RBI set.

- Finally, the finding that almost all subsidized households are not rent burdened robustly confirms the basic approach in the previous analysis. Although the data reviewed here do not include rent, it follows from the very low incomes and the low rent burdens that the subsidized rents are very low.

The data reviewed here do not shed any direct light on the largest uncertainty in the previous analysis — the rate at which voucher holding units in the ACS report their Tenant Total Payment as opposed to their Contract rent — however, that uncertainty had the primary effect of varying the quality of the fit between the low rent set and the URB set and so the overall confidence in the conclusions. The data presented here offer a more direct and robust route to the surprising bottom line of the previous analysis, which is that we should discount commonly reported ACS rent burden statistics, because many ACS “rent-burdened” households are receiving subsidy and merely appear to be rent-burdened due to noise in income or rent reporting. Truly rent burdened households are both less numerous than reported and less concentrated among the ELI population. The truly rent burdened slice of ELI households is further reduced by the share that are Unsustainably Rent Burdened, over half of whom report no means-tested program participation. The HUD data reviewed here do not provide additional insight into that group.

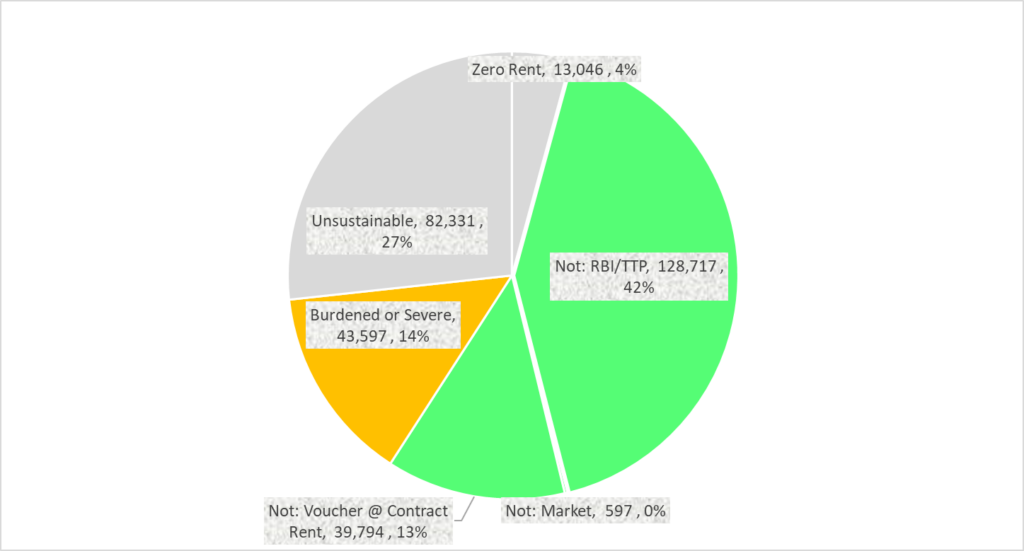

The chart below reproduced from the prior post in this series, summarizes our understanding: Perhaps as few as 14% of ELI households are cost-burdened or severely cost-burdened. The share certainly could be somewhat higher — we do not have a good understanding the Unsustainably Rent Burdened slice. But since we now direct evidence that a majority of the ELI households are in housing subsidy programs and not rent-burdened, we do believe that the analysis here better reflects reality than analyses that make uncritical use of the ACS data, for example, this report from the National Low Income Housing Coalition, which finds that 80% of ELI renters are burdened or severely burdened.

Rent Burden of Extremely Low Income Households: ACS 2022 5-year data (N=308,082)

Resources

- Spreadsheet with computations

- Related posts

- Data on extremely low income renters

- The unsustainably rent burdened — part I

- The unsustainably rent burdened — part II

- Counting subsidized housing units in Massachusetts (methodology post)

- Census based counts of affordable housing (methodology post)

- Microdata for housing needs assessment (methodology post)

- Low and moderate income population (methodology post)