As noted previously, the Subsidized Housing Inventory is not a good metric of the affordable housing units in Massachusetts. Fortunately, over the past few years, Jennifer Gilbert and her team at the Housing Navigator have done the hard work to rigorously assemble a database of affordable housing units in Massachusetts. Their goal was to create a friendly search tool for people seeking affordable housing. but the foundation for that tool is a complete database of affordable housing units. They have published the high level counts from that database as of January 2024 and those counts are reproduced below.

Table 1: Affordable Housing Units in Massachusetts, January 2024

| Affordable Units | Rent based on income | Fixed below market | Total |

|---|---|---|---|

| Non-age restricted | 78035 | 50903 | 128938 |

| Age restricted | 70201 | 10445 | 80646 |

| Total | 148236 | 61348 | 209584 |

The conclusion of this post is that these counts are credible. They give us the best idea we have as to the statewide total count of affordable units. The numbers were rigorously prepared, they reconcile adequately with other published data from state and federal administrative agencies, and they are not contradicted by Census data. (It is worth noting that the City of Boston has prepared a good analysis of units within Boston.)

The Navigator Data

The Navigator covers income-restricted rental housing units available to the public. For short, we’ll refer to “affordable housing” in this post, but to be clear, that term is being used to refer the Navigator’s selection of housing units.

- It includes rental housing not ownership housing.

- It includes income-restricted housing, housing that by law may only be rented by households with limited income, not “naturally occurring” affordable housing — unregulated housing which happens to be inexpensive. Income restrictions are usually defined with reference to Section 8 standards.

- It excludes group homes and other specialized housing that is not available to households for rental.

- It excludes mobile housing vouchers, although people with mobile vouchers might use the database to find units and use their vouchers in income restricted units.

The term “rent based on income” means that the rent will be set at some manageable amount, generally not in excess of 30% of the eligible household’s actual income. “Fixed below market” means that the unit’s rent is set at a fixed low level, usually 30% of the unit’s income eligibility threshold, but will not vary by the actual income of the household and so could exceed 30% of the household’s income if the household’s income is materially below the unit’s income eligibility threshold. The legal income eligibility threshold is a household income maximum, not a minimum, although owners of “fixed below market” units may also impose a minimum income as well, because like any landlord, they want tenants who can pay the rent.

The Navigator team collected, analyzed, and deduped every available agency list of affordable housing units, including the following:

- State public housing database underlying the CHAMP system.

- Federal public housing and other HUD assisted properties

- Grant making databases of properties receiving federal LIHTC, state LIHTC, tax-exempt financing, and other subsidies from the state’s lead housing agency (Housing and Livable Communities) and its affiliated quasi-public agencies (MassHousing, Massachusetts Housing Partnership)

- Properties receiving federal low income housing tax credits as reported by HUD

- CEDAC’s affordability preservation database

- The state’s subsidized housing inventory

- Major city housing agencies

Where available property data was incomplete as to income-restrictions or rent levels, the team sought information from property managers and/or researched the recorded deed restrictions governing the properties. For more information, see the Navigator’s FAQ sheet. In interviewing CEO Jennifer Gilbert I came away fully convinced of the integrity and completeness of the Navigator unit count.

Comparing Navigator Totals to Agency Totals

The table below compiles published agency counts of affordable units. These counts are roughly consistent with the Navigator count and they give a sense of the components of the count.

Table 2: Agency counts of Affordable Units in 2024

| Program or category | Units — Rent Based on Income | Units — Fixed below market |

|---|---|---|

| (1) State Public Housing — Elderly and Disabled | 28,700 | |

| (2) State Public Housing — Families | 12,800 | |

| (3) Federal Public Housing | 29,957 | |

| (4) Federal Moderate Rehabilitation | 1,662 | |

| (5) Federal Section 8 Project Based Rental Assistance (PBRA) | 59,394 | |

| (6) 202/PRAC (Federal Supportive Housing for the Elderly ) | 3,752 | |

| (7) 811/PRAC (Federal Supportive Housing for Persons with Disabilities) | 967 | |

| (8) Federal low income housing tax credit units from HUD LIHTC property database | 68,899 | |

| (9) Total units from administrative program counts | 137,232 | 68,899 |

| (10) Adjustment 1: Tax credit projects that are preservation of Section 8 Project-Based Rental Assistance projects (duplicate PBRA count) | (21,121) | |

| (11) Adjustment 2: Tax credit units with federal Housing Choice Vouchers that are project based (should be classified as “Rent based on income”) | 12,752 | (12,752) |

| (12) Adjustment 3: 40B projects not HLC or HUD Subsidized | ~16,000 | |

| (13) Adjustment 4: Units affordable pursuant to inclusionary by-laws and other local agreements. | ~4,242 | |

| (14) Adjustment 5: HLC subsidized units without federal tax credits | ~5,771 | |

| (15) Adjusted total administrative program counts | 149,984 | ~61,038 |

| (16) Navigator Total | 148,236 | 61,348 |

| (17) % Difference between Navigator and Administrative | 1.2% | -0.5% |

Line Notes to Table Above

- Recent count supplied by Housing and Livable Communities, Undersecretary of Public Housing & Rental Assistance at Massachusetts Executive Office of Housing & Livable Communities.

- Same source as 1.

- Using count supplied from HUD Program Data as of December 31, 2023; direct download here. See also Federal Public Housing Dashboard.

- Same source as 3. See Mod Rehab program description here.

- Same source as 3. See PBRA program description here.

- Same source as 3. See Section 202 program description here.

- Same source as 3. See Section 811 program description here.

- Source: Federal Low Income Housing Tax Credit database. See program description here. Affordable unit count derivation explained in attached spreadsheet.

- Sum of lines (1) through (8)

- Data on tenants of federal tax credit properties shows that 72.3% received some form of federal rental assistance. Among these in turn, 42.4% were receiving project based rental assistance. These are likely older PBRA properties that were rehabilitated and preserved as affordable using tax credits. Thus, they are already counted under line 5. 72.3% * 42.4% * Line 8 yields Line 10. Note that the tenant database only matches information for 47.9% of Massachusetts tax credit properties; we are extrapolating the same ratios to the unmatched properties. See tables 9, 11 and 12 from the tenant data in the attached spreadsheet.

- The adjustment in this line is based on the same sources as line 10. 25.6% of tax credit properties receiving federal rental assistance have HUD project based vouchers. 72.3% * 25.6% * Line 8 yields Line 11. HUD project based vouchers are a subgroup of HUD housing choice vouchers.

- This approximate count was supplied by the Housing Navigator staff after review of their data.

- This approximate count was supplied by the Housing Navigator staff after review of their data.

- This adjustment is based on applying 8.4% to line 8. 8.4% is derived as the ratio of total affordable units without federal tax credits to total affordable units with federal tax credits within the HLC Intelligrants database for projects with apparently complete data (those placed in service after 2015).

- Line (9) with additions/(subtractions) in lines (10) through (14). The “~” symbol denotes approximation.

- The Housing Navigator totals for comparison — from the first table in the post.

- Line (15) – Line (16) — as percent of Line (16).

Comparing Navigator Totals to Census Data

As noted in the several blue-boxes below (added on November 30), several weaknesses have emerged in the reasoning in this whole section. This section derives confirmation of administrative and Navigator estimates from Census data. Overall, while not bottom-line wrong, the argument is weak. The colder, more limited conclusion is that the Census data do not contradict administrative and Navigator estimates.

The American Community Survey (ACS) is the primary Census data product offering details about households at a regional level. The ACS does not differentiate affordable units in our strict sense — that is, it does not track whether units are legally reserved for people of low income. But it turns out that we can make a rough identification of income restricted units in the ACS data which provides another confirmation point for both the Navigator and administrative data above.

The first observation to make is that there is essentially no market rate housing in Massachusetts that is affordable at the 30% of AMI level (i.e., for which rent is less than the 30% AMI level). In recent Zillow searches, we found essentially no units affordable at the 30% ELI level or even twice that level. The table below shows results for 3 bedroom searches in low/moderate income communities in the Boston area. Similar tables in the attached spreadsheet show the results of single bedroom searches and searches in the Springfield area.

The “first observation” in the paragraph above is not correctly stated. The Zillow searches only prove that there is no newly offered market rate housing in Massachusetts that is affordable at the 30% of AMI level listed on Zillow. Zillow does not speak to existing long-term tenancies and we do not even know the extent to which Zillow is representative of current rent offerings. It is probably true that there is little or no market rate housing affordable to ELI households, but these data do not prove that.

Table 3: 3 Bedroom Search results from Zillow on 10/31/2024 at HUD Income Levels for 4 Person Households

| 2024 HUD Income Level | Maximum Affordable Rent | Brighton Results | Roxbury Results | Everett Results | Malden Results | Lynn Results | |

|---|---|---|---|---|---|---|---|

| Extremely Low Income Limit | $48,950 | $1,224 | 0 | 0 | 0 | 0 | 0 |

| Very Low (50%) Income Limit | $81,600 | $2,040 | 0 | 1 | 0 | 0 | 0 |

| 2x ELIL | $97,900 | $2,448 | 0 | 1 | 0 | 0 | 0 |

| Low (80%) Income Limit | $130,250 | $3,256 | 133 | 20 | 13 | 18 | 12 |

| Median Family Income | $148,900 | $3,723 | 337 | 42 | 21 | 27 | 17 |

| All rent levels | All | 951 | 172 | 29 | 34 | 21 |

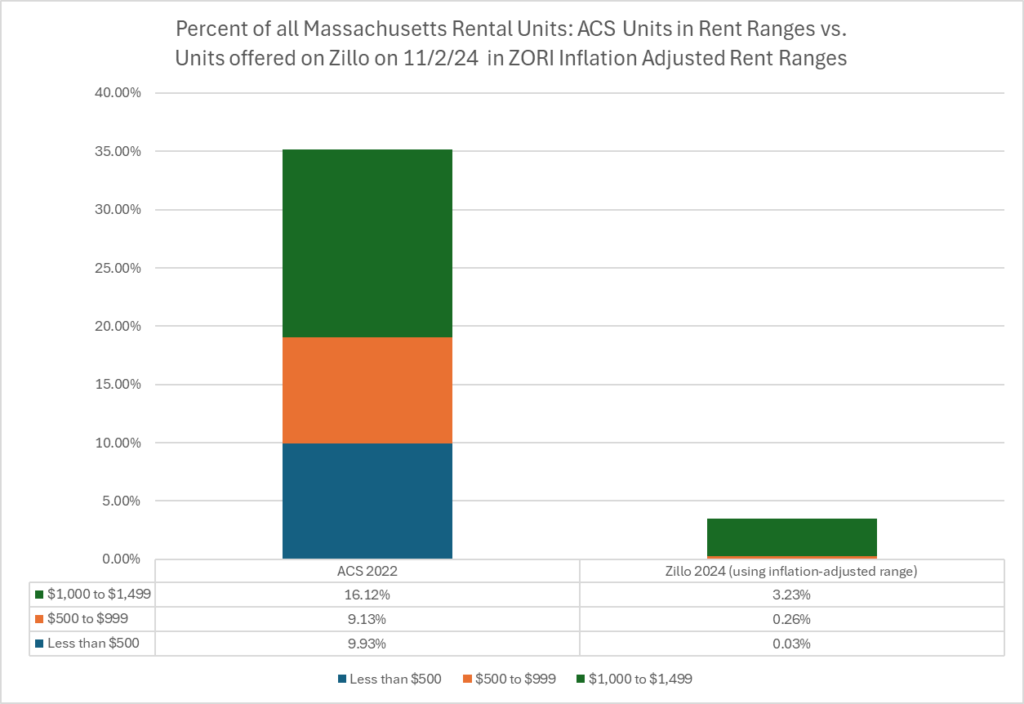

We did another set of statewide searches to facilitate a comparison to the 2022 ACS data. The ACS tabulates Massachusetts units according to tenant reported rent in $500 ranges. We inflated these ranges to 2024 levels by 15%. This 27 month inflation percentage is a rough estimate based on Zillow’s Observed Rent Index. Zillow does not provide statewide inflation rates, but ZORI showed inflation of 12% in the Boston area and 18% in the Springfield and Worcester areas, comparing September 30, 2024 to the average for 2022. 15% is reasonable mid-range guess.

The graphic below shows that the American Community Survey for 2022 reports a total of over 1/3 of the rental units in the state as renting in ranges below $1,500 in 2022. By contrast, Zillow in November 2024 only showed 3.7% of the offered units of any size in the state renting below $1725 ($1500 inflated 15%) and only 0.3% renting below $1,150 ($1000 inflated 15%). Households at the 2022 HUD Extremely Low Income levels constituted approximately 1/3 of renters. For most of them, affordable rent would be below the $1000 rent level. The chart shows that despite the large number of apparently low rent units appearing in the Census, ELIL households actually faced a complete lack of affordable market rate housing. See attached spreadsheet.

Same overreach as above: The chart shows only that ELIL households seeking new housing face a complete lack of market options. It does not speak to existing tenancies. Again, it is probably true that there is little or no market rate housing affordable to ELI households, but these data do not prove that.

Percent of all units in 2022 rent ranges vs Zillow percentages for same rent ranges

(27 months later, inflation adjusted)

We can make an important inference from the graphic above. We know that the American Community Survey is based on a survey of households; for rental units, the ACS is talking to tenants, not landlords or property managers. The ACS data as to rent is based on what the tenant reports. We also know that tenants usually report the rent payments that they actually make themselves (as opposed to the true total rent that being subsidized by government programs). Knowing this, and knowing that there is no market rate housing at the ELI level, we can infer that in the ELI rent ranges, the low reported rents are essentially all subsidized. In other words, we can take the ACS count of units that show as affordable to and occupied by people below HUD’s 30%-AMI (“Extremely Low Income Level”) as a count of ELI-occupied subsidized housing. The National Low Income Housing Coalition developed such an affordable/occupied-by count from the 2022 ACS data, finding a total of 145,391 of ELIL Massachusetts households that are in homes that affordable at the ELIL level (including some vacant units with affordable rents).

The preceding paragraph’s suggested inference from the graphic is probably true but not robust. Thank you to Luc Schuster at Boston Indicators for commenting that “market rate rental units currently listed through a source like Zillow aren’t quite apples to apples to all reported rents in the ACS—largely because when landlords list a unit anew that’s a common opportunity to raise the rent more than they do for longer-standing tenants. Also, longer-standing tenants in cheaper units are less likely to turn over, all things equal.” This point is well taken: It does not appear possible, using only the data from the Census, to make a rigorous inference from the minimum rents in Zillow’s database of currently offered market rate rents to the minimum rents being paid by existing tenants in market rate apartments. The ACS data could allow us to quantify the two dynamics that Luc points to, but the ACS data cannot allow us to quantify those dynamics differentially for market and subsidized units. So, even with the Zillow data, it seems impossible to exclude the possibility that some of the very low rent units that the ACS reports could be market rate units with long term tenants.

How does this ACS count compare to the Navigator and administrative data? We can use ELIL occupancy rates from the administrative data to develop a count of ELIL-occupied subsidized units. These units are renting at or below 30% of the ELIL threshold as detailed in the table below. As shown in the last two lines, this estimate comes quite close to the ACS based count developed by the NLIHC.

Table 4: Prediction of American Community Survey Count of Units Affordable and Available to ELIL Households from Agency Data (Affordable and Available roughly equivalent to ELI Occupied at ELIL Affordable Rent)*

| Units | %ELI Occupied at ELIL Affordable Rent* | Count ELI Occupied at ELIL Affordable Rent* | |

|---|---|---|---|

| (1) State public housing | 41,500 | 78% | 32,370 |

| (2) Federal Public Housing | 29,957 | 78% | 23,366 |

| (3) Federal Mod Rehab | 1,662 | 87% | 1,446 |

| (4) Federal Project Based Section 8 Rental Assistance | 59,394 | 79% | 46,921 |

| (5) 202/PRAC (Federal Supportive Housing for the Elderly) | 3,752 | 80% | 3,002 |

| (6) 811/PRAC (Federal Supportive Housing for Persons with Disabilities) | 967 | 94% | 909 |

| (7) Tax credit units with federal Housing Choice Vouchers that are project based | 12,752 | 79% | 10,074 |

| (8) Tax credit units with tenants having Housing Choice Vouchers that are tenant based vouchers | 9,166 | 31% | 2,860 |

| (9) Other Fixed Below Market Units | 51,872 | 0% | – |

| (10) Not yet accounted for federal Housing Choice Vouchers | 31% | ||

| (11) State vouchers MRVP/AHVP | 11,000 | 55% | 6,061 |

| (12) Total Agency Predicted Count (2023-4)* | |||

| (13) National Low Income Housing Coalition Count From American Community Survey (2022) | 145,391 (46% of ELI renters) |

Line Notes to Table Above

For the first column in most lines, see the first comparison table. These notes explain the second column.

- We do not have an ELIL occupancy rate for state public housing. We are assuming the same ELIL occupancy as for federal housing. This is reasonable as they have similar average income levels (22,963/24,212, fed/state) and similar mixes of family vs elderly/disabled tenants (68%/69% state/fed household count). See the attached spreadsheet

- Using rates supplied from HUD Program Data as of December 31, 2023.

- Same source as 2.

- Same source as 2.

- Same source as 2.

- Same source as 2.

- Assuming same ELI rate as federal project based rental assistance, line 4. HUD project based vouchers are a subgroup of HUD housing choice vouchers. See note to line 11 in Table 2.

- Based on data for tenants of tax federal credit properties as discussed in note to line 10 in previous table, 18.4% * 72.3% * 68,899= 9,166 tax credit units are occupied by tenants with mobile Housing Choice vouchers, the number in the first column in line 10. Turning to the second column in line 10: The exception to the general rule about ACS response — that tenants report as rent what they pay themselves — is for tenants with mobile vouchers: Mobile voucher holders are split as to what they report, with approximately 60% reporting the full contract rent and 40% reporting their own payment. We are assuming 40% of the these units report their tenant payment and that 78% are ELIL. 78% is the Housing Choice average ELIL rate from HUD Program Data. 40% of 78% is 31%, the number in column 2 for line 8.

- “Other Fixed Below Market Units” include some (25,860) tax credit units that have no rental assistance (i.e, no PBRA, no HCV project based, or no HCV tenant based). Perhaps 10 or 15% of all Massachusetts tax credit projects do rent at the ELIL level, or at least that is the current target. But many of have these have project-based vouchers and so have already been counted on line 8. Among non tax-credit projects in the “Other Fixed Below Market Units” category — 40B, Inclusionary Zoning, and other projects not subsidized by HLC — few are likely to be affordable at the ELIL level. For lack of a finer number, we round this line to 0% affordable at the ELIL level.

- This line has

a computation error(marked with a strike through) and shows corrections (underlined) reflected in this note as of November 30. The Housing Choice Voucher count from HUD Program Data (99,530) with vouchers previously counted in lines 7 and 8 removed is 77,612. We additionally back out 7,000 HCV’s possibly attached to public housing units to get to the 70,712 count shown in this line. The reasoning for this adjustment is as follows: We know that a total of 20,000 Housing Choice Vouchers that are project based. If the estimate in line87 is correct, approximately11,0007,000 vouchers of the 77,612 are project-based and attached to something other than tax-credit units (20,000 known project-based Housing Choice Vouchers, less9,16612,752 attached to tax credit projects estimated in line 7). These11,0007,000 could be attached to units in 40B projects, inclusionary zoning projects, and/or public housing projects. To the extent that these vouchers are attached to public housing projects and also included in this line, they would result in double counting between this line and lines 1 and 2. We do know that many Public Housing Authorities attach some of the vouchers under their control to their own units to supplement their chronically limited revenue. We don’t have a good estimate of this, but it we understand it to be a substantial share of the11,0007,000 uncounted project vouchers. For the purposes of this analysis, we assume that all of the11,0007,000 are attached to Public Housing Authority units. So we remove these from the 77,612 to yield 70,612 so far uncounted HCV. The third column swing as a result of this choice is small because only 31% of these units are estimated to show in the ACS, as explained in note 8. - State voucher count from HLC. Assuming (for lack of better data) an even blend between project-based and mobile deployment of these vouchers and using federal ELIL rates.

- This is the total count of units that we expect would show to the ACS as occupied by ELIL households at ELIL affordable rent levels. These counts are ambiguous as to vacancy rates, but there are long waiting lists for most of these units, so vacancy rates are very low. Reflects corrections made to line 10.

- This is the total count of units that show in the ACS as available to ELIL households at ELIL affordable rent levels, based on analysis from the National Low Income Housing Coalition. These counts include units occupied by ELIL households at affordable rents and vacant units with rents that would be affordable to ELIL households.

There are two problems with the discussion above that do not emerge without review of the microdata: (a) The NLIHC’s ELI affordable count includes rent free apartments some of which may be subsidized, but some may fall in other categories; (b) the 40/60 split of tenant-based Housing Choice Voucher units reporting their own payment as opposed to contract rents — which we derived from a single reported study — does not fit especially well with the microdata. See additional discussion of these issues in a later post which brings in the microdata.

Note on rent burden

The analysis of the ACS by the National Low Income Housing Coalition generates another estimate which only reconciles softly to the agency data: NLIHC estimates that 80% of the 316,000 ELI renter households are rent-burdened, that is, they pay rent and utilities over 30% of their income, and 64% are severely rent burdened (paying over 50%). Consideration of how this finding reconciles to our administrative data requires restatement of some confusing concepts.

Our analysis above assumes that apartments that are leased with “Rent based on income” to administratively identified ELI households will show in the American Community Survey as both (a) occupied by households who are ELI and (b) having rent that is less than 30% of the ELI threshold. This is a robust assumption because the ELI population is the entire left end of the income distribution, from below the ELI threshold all the way down to zero; most ELI households have incomes well below the ELI threshold. Therefore in “Rent based on income” apartments, their rents are also well below 30% of the ELI threshold. Noise factors as to income will only rarely push these households to appear in the American Community Survey as non-ELI and noise factors as to rent will only rarely push their apartments to appear as renting above 30% of the ELI threshold. Conversely, if an ELI household is not in a subsidized unit, we believe based on the Zillow data that in almost all cases their rent is well above 30% of the ELI threshold and so well above 30% of their income, in other words, they are likely to be severely rent burdened.

The last sentence in the preceding paragraph (“Conversely, . . . “) is probably true but, as discussed above, the Zillow data does not confirm it .

The total count of ELI renter households is approximately 316,000 — we know this only from ACS data as analyzed by NIHLC and others. Based on our analysis of administrative data and Zillow data recapitulated in the preceding paragraph, this set of 316,000 households is partitioned into two groups: (1) Those in subsidized housing whom we have now counted three ways (Navigator, administrative, ACS) at a little under 150,000, 46% of the universe, all of whom reside in “Affordable and Available to ELI” apartments; (2) the rest — those not in subsidized housing, 54%, none of whom reside in “Affordable and Available to ELI” apartments, all of whom are rent burdened, and most of whom are severely rent burdened. [Note that there is a subset of the second group who are not actually rent burdened but appear so to the ACS because they are reporting the contract rent (unsubsidized) on their unit to the ACS. This group amounts to approximately 11% of the ELI population. See notes to line 8 above; attached spreadsheet includes computations.]

Given that only 54% are in the second group, how can it be that 80% of the ELI population is rent-burdened according to the NLIHC ACS analysis?

The preceding two paragraphs oversimplify a bit, but the question is still good: If roughly 46% of the extremely-low-income population is in rent-based-on-income housing (54% not so), how can it be that 80% show as rent-burdened in the American Community Survey?

Answer: Many of those in the first group can show as rent-burdened without moving them out of the first group. Their extremely low rent may be more than 30% of their extremely low income. This could happen two ways even though their rents are generally set at 30% of their income:

- As a matter of administrative policy, rent could be set above 30% of income. This is the case for some public housing tenants. For example, state public housing regulations, 760 C.M.R. 6.04, require family tenants with utilities included in rent to pay 32% of their income as rent.

- Their income or rent could be rounded or misreported in the American Community Survey. The Census Bureau asserts that there is little measurement error in the ACS, but there at least some evidence of measurement error as to rent. Table 2 in the study comparing ACS rent responses to administrative data shows that in federal public housing, only 53% of the ACS tenant payments were within $50 of the administratively matched tenant payment level. Additionally, their rent could be miscalculated administratively, but we do not have evidence to believe this happens much.

The 54% vs. 80% discrepancy does not appear to be troubling given the two plausible dynamics that could contribute to it.

The two dynamics offered above as explanations of the 54% vs 80% discrepancy are secondary; it turns out that many ELI households report rents well above 30% of their income at all rent levels, including 40% reporting rent over 100% of their income. These anomalous very high reported rents in likely rent-based-on-income housing, as opposed to the two possibilities noted above, are the primary explanation the 80% burden statistic. See discussion based on microdata here.]

Note on VLI Households

The argument of the NLIHC brief is that most of the housing shortage apparent at income levels above the ELI level is due to the shortage at the ELI level. The premise is that lower rent housing is available to people at higher income levels, because higher income households can always spend less than their maximum affordable amount. In particular, all affordable/available ELI housing is affordable/available to VLI households. As a result, the total VLI population, including ELI, faces a proportionately smaller housing shortage than the ELI population — 58 units per 100 households as opposed to 46. The NLIHC analysis does not publish a shortage estimate for VLI households who are not ELI, but it follows from their numbers that this group faces no shortage at all, a 69% surplus of available units. However, our data indicate that the housing affordable to ELI households in Massachusetts is all subsidized; it is, in fact reserved by policy, for ELI households. So, the VLI-but-not-ELI population cannot access these units and does face a shortage of Affordable/Available Units — 81 units per 100 households. This finding, for which computations are detailed in the attached spreadsheet, somewhat adjusts the NLIHC findings.

| ELI | VLI but not ELI* | All VLI | |

|---|---|---|---|

| Households | 316,201 | 168,230 | 484,545 |

| Affordable/Available Units per NHILC | 145,391 | 281,036 | 281,036 |

| NHLIC Affordable/Available rate | 46% | 167% | 58% |

| Affordable/Available Units corrected | 145,391 | 135,645 ** | 281,036 |

| Affordable/Available Units rate corrected | 46% | 81% | 58% |

** Note that our administrative data can account for at most 92,000 of these units as subsidized suggesting that there are some naturally occurring VLIL units, likely about 50,000 state wide, less than 2% of all units.

Conclusion

The robustly developed affordable housing counts from the Housing Navigator are consistent with agency data. As to the Census data, this much stands after the corrections made to this post on November 30, 2024: The Census data do not contradict the Navigator and agency data.

Resource spreadsheet here.