This post explores the American Survey Community data pertaining to Extremely Low Income renters in Massachusetts. All data are derived from the ACS 2023 1 year Public Use Microdata Sample. We classify renter households as Extremely Low Income closely following HUD Section 8 standards. A substantial majority of ELI renters show as elderly or disabled in the census data. The one surprising finding is that many of them report paying rent greater than their income. This can be partially explained by a previous finding that people with mobile rental vouchers often report their contract rent instead of their own payment, but the prevalence of rent in excess of income is hard to completely explain through that observation. We explore some alternative explanations and revisit our previous analysis of administrative data.

Characteristics of Extremely Low Income households

In previous posts, we explored how HUD defines the Extremely Low Income population and the challenges of applying HUD definitions using Census data. In the analysis in this post, we closely follow HUD income thresholds; specifically we use the second previously identified method for reconciling geographies (majority of PUMA).

Table 1 below shows a basic breakdown by income level and household size of all renter households — ELI households tend to be single person households. This is partly a result of the way HUD adjusts for household size — HUD sets relatively high income limits for smaller households.

Table 1: Massachusetts Renter Households by Income Level and Household Size (American Community Survey 2023, Total N=1,055,488*)

| 1-person | 2-person | 3-person | 4+ -person | All sizes | % 1-person | |

|---|---|---|---|---|---|---|

| Extremely Low Income | 192,061 | 65,685 | 39,164 | 31,643 | 328,553 | 58% |

| Very Low Income | 64,098 | 43,083 | 24,093 | 28,178 | 159,452 | 40% |

| Low Income | 71,898 | 50,019 | 29,850 | 28,785 | 180,552 | 40% |

| Not Low Income | 104,516 | 165,649 | 61,351 | 55,415 | 386,931 | 27% |

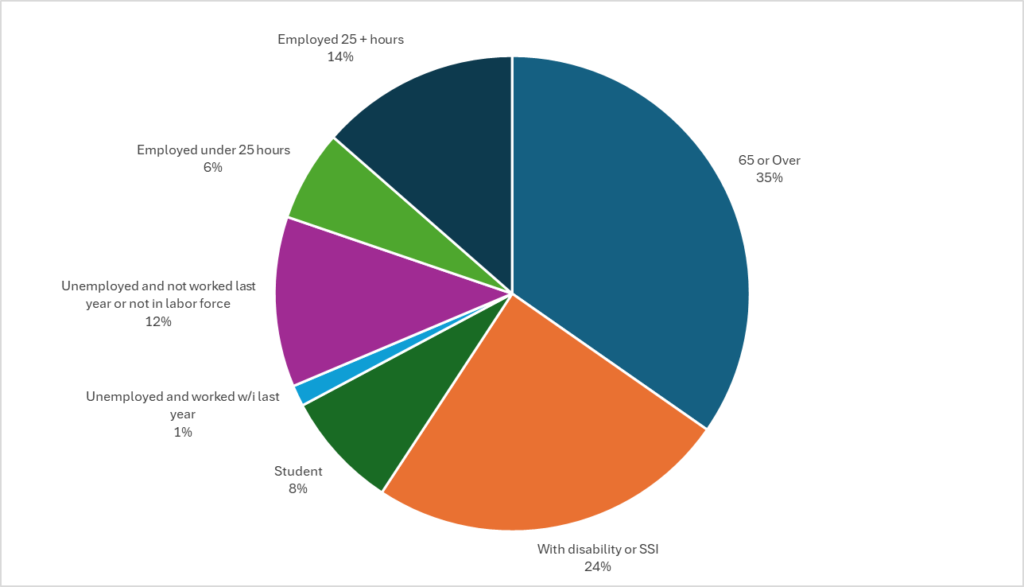

Chart 1 breaks ELI households by income-relevant characteristics. The classification below is based on the householder. The various possibly overlapping classifications are applied in order of preference starting from “65 or over” and proceeding clockwise. The disability category is based on the householder under 65 receiving SSI or saying “Yes” to any of six disability questions asked in the American Community Survey. Because single person households dominate among ELI households, it does not make too much difference whether one classifies households based on the householder (person whose name is on the lease) or other household members. The chart below shows findings similar to a national chart appearing in the National Low Income Housing Coalition Gap Report; that national chart factors in the status of both the householder and any spouse. A table in the “HH Characteristics” tab of resource spreadsheet shows the same analysis for different income levels and tenure types.

Chart 1: Massachusetts Extremely Low Income Renter Households by exclusively-defined characteristics of householder

(American Community Survey 2023, Total N=328,553*)

Rent Expenditures by Extremely Low Income households

Table 2 below classifies renter households in two dimensions. Down the side, households are classified by Section 8 income level. Across the top, they are classified by whether the rent for their apartment is affordable at the upper threshold for that income level. For example, in the top left cell, 120,759 households have incomes at or below the ELI threshold (roughly 30% of the Area Median Income) and are paying rent at or below 30% of that ELI threshold. In the next cell over, 48,680 households have incomes at or below the ELI threshold and are paying rent above 30% of the ELI threshold but below 30% of the VLI threshold (roughly 50% of Area Median Income).

Table 2: Massachusetts Renter Households by Income Level and Rent Level (American Community Survey 2023, Total N=1,055,488*)

| HUD Income Level | ELI Affordable | VLI Affordable | LI Affordable | Not LI Affordable | No Rent | Total |

|---|---|---|---|---|---|---|

| Extremely Low | 120,759 | 48,680 | 89,564 | 55,356 | 14,194 | 328,553 |

| Very Low | 18,905 | 32,830 | 70,751 | 30,276 | 6,690 | 159,452 |

| Low | 10,117 | 27,854 | 85,522 | 51,009 | 6,050 | 180,552 |

| Not Low | 9,068 | 32,462 | 123,528 | 210,584 | 11,289 | 386,931 |

| Total | 158,849 | 141,826 | 369,365 | 347,225 | 38,223 | 1,055,488 |

* Includes tenure type 3 (rent paid) and type 4 (non-owner occupant, rent free). Both types are classified as renter-occupied. See American Community Survey Subject Definitions, page 44. Vacant units are excluded from this count.

Rent under 30% of ELI Level — Affordable and Available units

The NLIHC gap report defines the concept of “affordable and available” housing for ELI households, consisting of housing units with rent under 30% of the ELI threshold that are either occupied by ELI households or vacant. Table 2 shows 120,759 ELI Affordable units and 14,194 No Rent units that are occupied by Extremely Low Income households. Table 2 excludes vacant units. There were 7,864 vacant units available for rent below the ELI affordable threshold in the ACS 2023 data. (See Vacant Unit Rents tab in resource spreadsheet.). These three components add to 142,817 units that are “affordable and available” to ELI households — a rate of 43 units per 100 ELI households. This is not statistically different from the 46 per 100 rate in the NLIHC gap report for Massachusetts based on 2022 ACS data (for variance analysis, see rent vs. income tab in the resource spreadsheet and Variance analysis from prior post). Our estimate of approximately 143,000 households is an estimate subject to sampling error and the 90% confidence interval is approximately 134,000 to 151,000.

It is clear that the estimated 120,759 ELI households that report paying ELI Affordable rents are among the neediest in the state — 91% overall and 96% under the age of 65 receive some form of public assistance (welfare, SSI, food stamps, or health insurance).

No Rent Households

The “No Rent” category in Table 2 is 4% of all renter households statewide and also 4% of Extremely Low Income renter households. It seems plausible that these include many public housing tenants and voucher holders, but it does not seem possible to estimate with any confidence either (a) how many of these “No Rent” tenants receive housing support or (b) what types of housing support they receive. We have the following conflicting data points:

- The Boston Housing Authority reports that among their 19,000 voucher holders, 17% pay zero rent and among their 10,000 public housing residents, 7% pay zero rent. Additional tenants in both categories pay rent under $100 per month. Some tenants who make the lowest payments may think of their rents as zero. If the Boston rates applied statewide, that could explain all of the “No rent” cases among the ELI and VLI households. (ELI and VLI households account for most of the supported housing in the state.) But different housing authorities have different income ELI/VLI mixes among their tenants and the prevalence of zero rent will vary across public housing authorities and is not publicly compiled.

- Tending to suggest, on the contrary, that supported tenants do not account for most of the “No rent” tenants: Among “No Rent” tenants, 84% at the ELI level and all at the higher levels, do report some income in the ACS. The 84% at the ELI level who do report income, report an average income of $15,000. For those who acknowledge that much income on a census form, it seems unlikely that a housing authority would be allocating them a no-rent unit or voucher.

- Among ELI “No Rent” tenants, 71% receive some form of non-housing public assistance (welfare, SSI, food stamps, or health insurance) as compared to 77% of all ELI households; in particular, 39% of ELI “No rent” tenants receive food stamps as opposed to 59% of all ELI tenants. If “No Rent” tenants were the zero-income neediest in public housing one would expect these inequalities to run the other way. However, these inequalities may not be statistically significant.

- The ACS documentation states about no rent units: “Such units are generally provided free by friends or relatives or in exchange for services such as resident manager, caretaker, minister, or tenant farmer. Housing units on military bases also are classified in the “No rent paid” category.” (Subject Definitions, Page 44.) This statement is not supported by any data offered in the document.

Households with rent greater than income

A surprising finding shown in Table 3 in the microdata is that 131,080 ELI households (40% of ELI households) report paying rents above their household incomes, as do a few VLI and LI households.

Table 3: Massachusetts Renter Households by Income Level and Rent as % of Income

(American Community Survey 2023, Total N=1,055,488*)

| HUD Income Level | Under 30%** | Under 50% | Under 80% | Under 100% | Over 100% | Total |

|---|---|---|---|---|---|---|

| Extremely Low | 69,787 | 52,936 | 48,120 | 26,630 | 131,080*** | 328,553 |

| Very Low | 38,573 | 64,561 | 44,581 | 6,886 | 4,851 | 159,452 |

| Low | 83,432 | 80,230 | 14,980 | 766 | 1,144 | 180,552 |

| Not Low | 340,546 | 42,276 | 3,676 | 433 | 386,931 | |

| Total | 532,338 | 240,003 | 111,357 | 34,715 | 137,075 | 1,055,488 |

* Includes tenure type 3 (rent paid) and type 4 (non-owner occupant, rent free). Both types are classified as renter-occupied. See American Community Survey Subject Definitions, page 44. Vacant units are excluded from this count.

** Includes households showing no rent.

*** Includes 18,378 households paying rent but showing no income and 7,777 households paying rent that is below 30% of the ELI threshold, but nonetheless over 100% of their income. Does not include 241 Households with negative income. Compares to Table 5 in this subsequent post with these includes/excludes.

In the NLIHC gap report, these rent-greater-than-income households are classified as cost-burdened together with all ELI households paying over 30% of their income as rent. However, this cannot be the right way to look at these households. The likely dominant explanation is that they are rental voucher holders who are reporting the contract rent as opposed to their own contribution. There are approximately 110,000 tenant vouchers in Massachusetts, 99,000 through the federal Housing Choice Voucher program and 11,000 through two state voucher programs. In a previous analysis, we credited a research finding that only approximately 60% of federal housing choice voucher holders report their contract rent on the American Community Survey. However, it is possible that tenant income reporting behavior in the American Community Survey varies depending on how local authorities talk about vouchers. We do know that approximately 25,000 of the vouchers are project-based statewide and it would be inconsistent with research and common sense that these voucher holders would know or report a contract rent amount. So, reporting of contract rent is likely to account for at most 85,000 of the 131,080 instances of rent greater than income. And based on the one true comparison of administrative data and census data that we are aware, of it should account for only 51,000 (60% of 85,000). See previous discussion, and see Table 4 and notes in previous post reconciling administrative counts.

An alternative class of explanation for rent-greater-than-income would that be that rent does factually exceed income, but the households are in a temporary low-income condition — either as students or unemployed — and are relying on informal assistance. Or possibly they are coasting on wealth. The ACS questionnaire asks the respondent for their “best estimate of the TOTAL AMOUNT during the PAST 12 MONTHS” (emphasis in the original), so the income drought would have to sustained.

- Households in which the householder is enrolled in school account for only 4% of ELI households where rent is under 30% of income, but 16% of rent-greater-than-income ELI households (21,238 of 131,080). Student-led ELI households have lower rates of use of any form of public assistance than other ELI households, 47% vs. 80%; in particular, for food stamps 24% vs. 63% and for medical assistance 37% vs. 70%. It does seem plausible that student led households that are receiving family support account for some of the nominally rent-greater-than-income ELI households.

- Households in which the householder is unemployed account for only 3% of ELI households where rent is under 30% of income, but 9% of rent-greater-than-income ELI households (11,179 of 131,080). However, they have only modestly different public assistance utilization rate from other ELI households (68% vs. 77%).

- Households with investment income over $100 in the past 12 months account for only 2.7% of the ELI population and they are not overrepresented in the rent-greater-than-income group.

It does look like students and possibly some unemployed might explain some of the rent-greater-than-income households, but wealth is not a likely explanation. Vouchers must explain the largest share of the rent-greater-than-income households, but even if we assume a higher rate of voucher holders reporting contract rent than we previously assumed, the identified explanations probably don’t add up to enough rent-greater-than-income units. We can conjecture that some households just are not fully reporting their income, but we have no basis for quantifying that conjecture.

Revisiting administrative data

In a previous post reconciling administrative counts of housing available to and affordable ELI households with census data, we did not have the benefit of the microdata and relied on published totals. The microdata findings above force a re-examination of that previous reconciliation. The basic premise of that reconciliation (based on a review of Zillow rental listings) was that all housing that is affordable to ELI households is subsidized. The post built up from administrative data an estimate of ELI-affordable subsidized housing as it should appear to the ACS. The post then compared that estimate to the Affordable/Available estimate in the NLIHC gap report for Massachusetts which was based on the 2022 ACS data. The two estimates were very close — both near 146,000. Our analysis in this post produces a similar estimate from 2023 microdata. But the microdata raise two issues with our happy reconciliation between the Census-based and administrative counts.

- The Census-based counts include 14,194 units in the “No rent” category as ELI-affordable subsidized housing — we could not see that subgroup without the microdata. As discussed above, some unknown share of that category may not be subsidized housing, but rather family-assisted housing or perhaps housing offered as compensation for services. It is not even clear that we should think of these households as ELI.

- Additionally, the very high number of rent-greater-than-income households strains our research-based assumption that only 60% of mobile voucher holders report their contract rent in the ACS. To the extent the true percentage is higher (more consistent with the unexpectedly high number of rent-greater-than-income households), that would mean fewer voucher units are showing as affordable in the ACS. Our administrative estimate was designed to predict census counts and so factored in the 60% rate. To the extent the true rate is higher, this would reduce the administrative estimate which expects the census would see as affordable the estimated 40% of voucher units that report the tenant payment. Increasing the 60% rate (decreasing the 40% rate) would decrease lines (8) and (10) of the administrative-estimate in Table 4 of the previous post. These lines contribute 27,070 units to the administrative estimate; going to 80% contract rent reporting from 60% would cut that in half to 13,535 units.

The good news is that both of these adjustments — one to the Census-based estimate and one to the administrative-based estimate (designed to predict the Census-based estimate) are in the same direction and are of very roughly the same magnitude. We can still reach a soft and general conclusion that the census estimate does not contradict with the administrative estimate, but we now understand more of the conceptual uncertainty of the census estimate. The conceptual uncertainty adds to the sampling uncertainty which we did not fully explore in the previous post.

Resources

- Resource Spreadsheet (Excel)

- Database of 2023 American Community Survey Microsample (1-yr) with HUD income levels applied (Access)

- Methodology study on ACS geographies and income definitions

- Understanding and Using the American Community Survey Public Use Microdata Sample Files (2021)

- 2023 American Community Survey Data Dictionary

- 2023 American Community Survey Subject Definitions

- 2023 American Community Survey Questionnaire

- National Low Income Housing Coalition “Gap” report

Maybe I missed it but what about retirees drawing down their savings? Presumably that wouldn’t count as income but it could cover rent-income gaps.

Thank you for the question. It was one that I asked, but didn’t say enough about in the text. The text above says only that: “Households with investment income over $100 in the past 12 months account for only 2.7% of the ELI population and they are not overrepresented in the rent-greater-than-income group.”

Here are some additional data points tending to confirm that the rent-greater-than-income ELI households are not retirees drawing from savings:

It is worth noting that the following items are each separately inquired about for each person in the household in the ACS questionnaire and are all included in total household income: