As noted previously, the Subsidized Housing Inventory is not a good metric of the affordable housing units in Massachusetts. Fortunately, over the past few years, Jennifer Gilbert and her team at the Housing Navigator have done the hard work to rigorously assemble a database of affordable housing units in Massachusetts. Their goal was to create a friendly search tool for people seeking affordable housing. but the foundation for that tool is a complete database of affordable housing units. They have published the high level counts from that database as of January 2024 and those counts are reproduced below.

Table 1: Affordable Housing Units in Massachusetts, January 2024

| Affordable Units | Rent based on income | Fixed below market | Total |

|---|---|---|---|

| Non-age restricted | 78035 | 50903 | 128938 |

| Age restricted | 70201 | 10445 | 80646 |

| Total | 148236 | 61348 | 209584 |

The conclusion of this post (adjusted in August 2025 reflecting notes in text) is that these counts are roughly right. They were rigorously prepared and give us a good idea as to the statewide total count of affordable units. They are close to, but somewhat different from counts derived from administrative aggregates. (It is worth noting that the City of Boston has prepared a good analysis of units within Boston.)

The Navigator Data

The Navigator covers income-restricted rental housing units available to the public. For short, we’ll refer to “affordable housing” in this post, but to be clear, that term is being used to refer the Navigator’s selection of housing units.

- It includes rental housing not ownership housing.

- It includes income-restricted housing, housing that by law may only be rented by households with limited income, not “naturally occurring” affordable housing — unregulated housing which happens to be inexpensive. Income restrictions are usually defined with reference to Section 8 standards.

- It excludes group homes and other specialized housing that is not available to households for rental.

- It excludes mobile housing vouchers, although people with mobile vouchers might use the database to find units and use their vouchers in income restricted units.

The term “rent based on income” means that the rent will be set at some manageable amount, generally not in excess of 30% of the eligible household’s actual income. “Fixed below market” means that the unit’s rent is set at a fixed low level, usually 30% of the unit’s income eligibility threshold, but will not vary by the actual income of the household and so could exceed 30% of the household’s income if the household’s income is materially below the unit’s income eligibility threshold. The legal income eligibility threshold is a household income maximum, not a minimum, although owners of “fixed below market” units may also impose a minimum income as well, because like any landlord, they want tenants who can pay the rent.

The Navigator team collected, analyzed, and deduped every available agency list of affordable housing units, including the following:

- State public housing database underlying the CHAMP system.

- Federal public housing and other HUD assisted properties

- Grant making databases of properties receiving federal LIHTC, state LIHTC, tax-exempt financing, and other subsidies from the state’s lead housing agency (Housing and Livable Communities) and its affiliated quasi-public agencies (MassHousing, Massachusetts Housing Partnership)

- Properties receiving federal low income housing tax credits as reported by HUD

- CEDAC’s affordability preservation database

- The state’s subsidized housing inventory

- Major city housing agencies

Where available property data was incomplete as to income-restrictions or rent levels, the team sought information from property managers and/or researched the recorded deed restrictions governing the properties. For more information, see the Navigator’s FAQ sheet. In interviewing CEO Jennifer Gilbert I came away fully convinced of the integrity and thoroughness of the Navigator unit count.

Comparing Navigator Totals to Agency Totals

The table below compiles published agency counts of affordable units. These counts are roughly consistent with the Navigator count and they give a sense of the components of the count.

Note as of August 2025: Table 2, as originally published, failed to fully consider data from the Housing Choice Voucher dashboard which shows that were 18,638 project-based HCVs in Massachusetts as of January 1, 2024. Line 11 of this chart estimates 12,752 project-based vouchers assigned to tax credit units. As duly noted, line 11 uses a partial (47.9%) sample of tax credit units to derive that estimate. It is possible the partial sample is not representative and that the number of project-based vouchers assigned to tax credit units should higher in line 11. By federal law, project-based vouchers cannot be assigned to units in any program in the first 7 lines of the chart, but it may be possible that some of the additional vouchers are assigned to projects in line 13. Regardless of the mechanism, approximately 6,000 units should be added to the “Rent Based on Income” column and deducted from the “Fixed Below Market” Column. An additional shift reflects project-based Massachusetts Rental Vouchers of which there are approximately 5,000. We are making the assumption that the previously unaccounted for project-based vouchers are attached to already-accounted-for fixed-below-market units. These adjustments are now reflected in the chart. As a result, the line 17 comparison between administrative and Navigator data shows somewhat wider differences than before (originally line 17 showed 1.2% and -0.5%).

Table 2: Agency counts of Affordable Units in 2024

| Program or category | Units — Rent Based on Income | Units — Fixed below market |

|---|---|---|

| (1) State Public Housing — Elderly and Disabled | 28,700 | |

| (2) State Public Housing — Families | 12,800 | |

| (3) Federal Public Housing | 29,957 | |

| (4) Federal Moderate Rehabilitation | 1,662 | |

| (5) Federal Section 8 Project Based Rental Assistance (PBRA) | 59,394 | |

| (6) 202/PRAC (Federal Supportive Housing for the Elderly ) | 3,752 | |

| (7) 811/PRAC (Federal Supportive Housing for Persons with Disabilities) | 967 | |

| (8) Federal low income housing tax credit units from HUD LIHTC property database | 68,899 | |

| (9) Total units from administrative program counts | 137,232 | 68,899 |

| (10) Adjustment 1: Tax credit projects that are preservation of Section 8 Project-Based Rental Assistance projects (duplicate PBRA count) | (21,121) | |

| (11) Adjustment 2: Tax credit units with federal Housing Choice Vouchers that are project based (should be classified as “Rent based on income”), but see August 2025 HCV Adjustment. | 12,752 | (12,752) |

| (12) Adjustment 3: 40B projects not HLC or HUD Subsidized | ~16,000 | |

| (13) Adjustment 4: Units affordable pursuant to inclusionary by-laws and other local agreements. | ~4,242 | |

| (14) Adjustment 5: HLC subsidized units without federal tax credits | ~5,771 | |

| August 2025 HCV adjustment | 6,000 | (6,000) |

| August 2025 MRVP adjustment | 5,000 | (5,000) |

| (15) Adjusted total administrative program counts (with August 2025 adjustment) | 160,984 | ~50,039 |

| (16) Navigator Total | 148,236 | 61,348 |

| (17) % Difference between August 2025 revised Administrative and Navigator | +9% | -18% |

Line Notes to Table Above

- Recent count supplied by Housing and Livable Communities, Undersecretary of Public Housing & Rental Assistance at Massachusetts Executive Office of Housing & Livable Communities.

- Same source as 1.

- Using count supplied from HUD Program Data as of December 31, 2023; direct download here. See also Federal Public Housing Dashboard.

- Same source as 3. See Mod Rehab program description here.

- Same source as 3. See PBRA program description here.

- Same source as 3. See Section 202 program description here.

- Same source as 3. See Section 811 program description here.

- Source: Federal Low Income Housing Tax Credit database. See program description here. Affordable unit count derivation explained in attached spreadsheet.

- Sum of lines (1) through (8)

- Data on tenants of federal tax credit properties shows that 72.3% received some form of federal rental assistance. Among these in turn, 42.4% were receiving project based rental assistance. These are likely older PBRA properties that were rehabilitated and preserved as affordable using tax credits. Thus, they are already counted under line 5. 72.3% * 42.4% * Line 8 yields Line 10. Note that the tenant database only matches information for 47.9% of Massachusetts tax credit properties; we are extrapolating the same ratios to the unmatched properties. See tables 9, 11 and 12 from the tenant data in the attached spreadsheet. NOTE: This line may be correct, but it could also be too large an adjustment if PBRA properties are overrepresented in the partial data from the tenant database — this is likely because PBRA properties already have a good tenant reporting infrastructure and may do a better job reporting tenant data for LIHTC units.

- The adjustment in this line is based on the same sources as line 10. 25.6% of tax credit properties receiving federal rental assistance have HUD project based vouchers. 72.3% * 25.6% * Line 8 yields Line 11. HUD project based vouchers are a subgroup of HUD housing choice vouchers. We now see this line as likely inaccurate, but have not altered it, instead making an adjustment in new line “August 2025, HCV Adjustment.”

- This approximate count was supplied by the Housing Navigator staff after review of their data.

- This approximate count was supplied by the Housing Navigator staff after review of their data.

- This adjustment is based on applying 8.4% to line 8. 8.4% is derived as the ratio of total affordable units without federal tax credits to total affordable units with federal tax credits within the HLC Intelligrants database for projects with apparently complete data (those placed in service after 2015).

- Line (9) with additions/(subtractions) in lines (10) through (14). The “~” symbol denotes approximation.

- The Housing Navigator totals for comparison — from the first table in the post.

- Line (15) – Line (16) — as percent of Line (16).

Comparing Navigator Totals to Census Data

As noted in the several blue-boxes below (added on November 30, 2024 and August 23, 2025), fatal weaknesses have emerged in the reasoning in this whole section. This section derives confirmation of administrative and Navigator estimates from Census data. Overall, the argument is is speculative. The most we can say is that the Census data do not contradict administrative and Navigator estimates.

The American Community Survey (ACS) is the primary Census data product offering details about households at a regional level. The ACS does not differentiate affordable units in our strict sense — that is, it does not track whether units are legally reserved for people of low income. But it turns out that we can make a rough identification of income restricted units in the ACS data which provides another confirmation point for both the Navigator and administrative data above.

The first observation to make is that there is essentially no market rate housing in Massachusetts that is affordable at the 30% of AMI level (i.e., for which rent is less than the 30% AMI level). In recent Zillow searches, we found essentially no units affordable at the 30% ELI level or even twice that level. The table below shows results for 3 bedroom searches in low/moderate income communities in the Boston area. Similar tables in the attached spreadsheet show the results of single bedroom searches and searches in the Springfield area.

The “first observation” in the paragraph above is not correctly stated. The Zillow searches only prove that there is no newly offered market rate housing in Massachusetts that is affordable at the 30% of AMI level listed on Zillow. Zillow does not speak to existing long-term tenancies and we do not even know the extent to which Zillow is representative of current rent offerings. It is probably true that there is little or no market rate housing affordable to ELI households, but these data do not prove that.

Table 3: 3 Bedroom Search results from Zillow on 10/31/2024 at HUD Income Levels for 4 Person Households

| 2024 HUD Income Level | Maximum Affordable Rent | Brighton Results | Roxbury Results | Everett Results | Malden Results | Lynn Results | |

|---|---|---|---|---|---|---|---|

| Extremely Low Income Limit | $48,950 | $1,224 | 0 | 0 | 0 | 0 | 0 |

| Very Low (50%) Income Limit | $81,600 | $2,040 | 0 | 1 | 0 | 0 | 0 |

| 2x ELIL | $97,900 | $2,448 | 0 | 1 | 0 | 0 | 0 |

| Low (80%) Income Limit | $130,250 | $3,256 | 133 | 20 | 13 | 18 | 12 |

| Median Family Income | $148,900 | $3,723 | 337 | 42 | 21 | 27 | 17 |

| All rent levels | All | 951 | 172 | 29 | 34 | 21 |

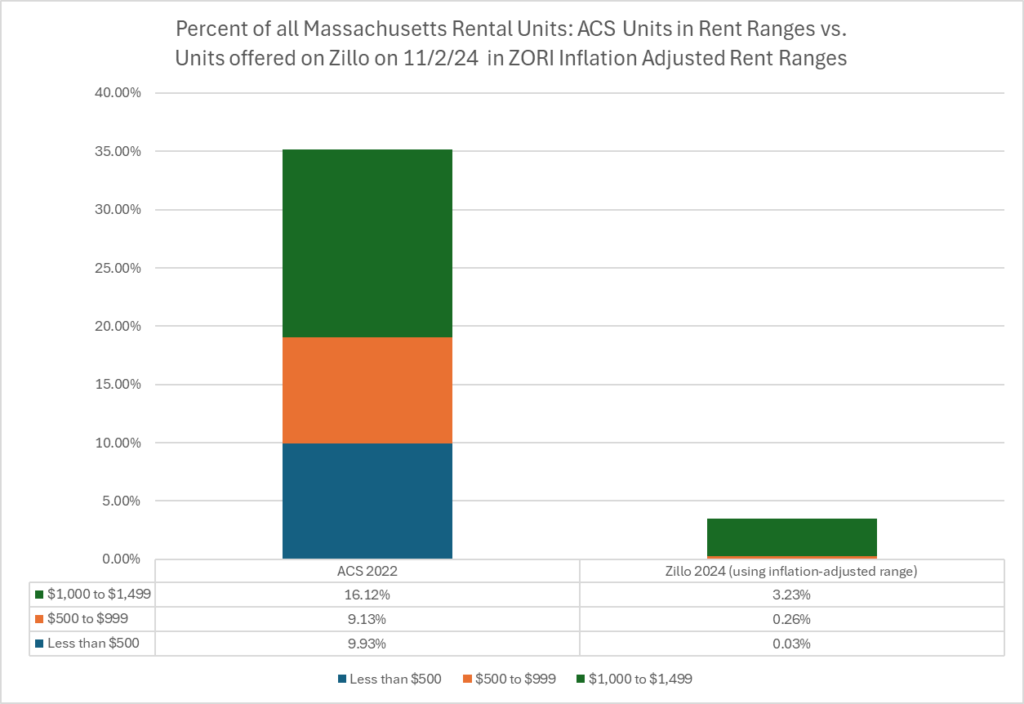

We did another set of statewide searches to facilitate a comparison to the 2022 ACS data. The ACS tabulates Massachusetts units according to tenant reported rent in $500 ranges. We inflated these ranges to 2024 levels by 15%. This 27 month inflation percentage is a rough estimate based on Zillow’s Observed Rent Index. Zillow does not provide statewide inflation rates, but ZORI showed inflation of 12% in the Boston area and 18% in the Springfield and Worcester areas, comparing September 30, 2024 to the average for 2022. 15% is reasonable mid-range guess.

The graphic below shows that the American Community Survey for 2022 reports a total of over 1/3 of the rental units in the state as renting in ranges below $1,500 in 2022. By contrast, Zillow in November 2024 only showed 3.7% of the offered units of any size in the state renting below $1725 ($1500 inflated 15%) and only 0.3% renting below $1,150 ($1000 inflated 15%). Households at the 2022 HUD Extremely Low Income levels constituted approximately 1/3 of renters. For most of them, affordable rent would be below the $1000 rent level. The chart shows that despite the large number of apparently low rent units appearing in the Census, ELIL households actually faced a complete lack of affordable market rate housing. See attached spreadsheet.

Same overreach as above: The chart shows only that ELIL households seeking new housing face a complete lack of market options. It does not speak to existing tenancies. Again, it is probably true that there is little or no market rate housing affordable to ELI households, but these data do not prove that.

Percent of all units in 2022 rent ranges vs Zillow percentages for same rent ranges

(27 months later, inflation adjusted)

We can make an important inference from the graphic above. We know that the American Community Survey is based on a survey of households; for rental units, the ACS is talking to tenants, not landlords or property managers. The ACS data as to rent is based on what the tenant reports. We also know that tenants usually report the rent payments that they actually make themselves (as opposed to the true total rent that being subsidized by government programs). Knowing this, and knowing that there is no market rate housing at the ELI level, we can infer that in the ELI rent ranges, the low reported rents are essentially all subsidized. In other words, we can take the ACS count of units that show as affordable to and occupied by people below HUD’s 30%-AMI (“Extremely Low Income Level”) as a count of ELI-occupied subsidized housing. The National Low Income Housing Coalition developed such an affordable/occupied-by count from the 2022 ACS data, finding a total of 145,391 of ELIL Massachusetts households that are in homes that affordable at the ELIL level (including some vacant units with affordable rents).

The preceding paragraph’s suggested inference from the graphic is probably true but not robust. Thank you to Luc Schuster at Boston Indicators for commenting that “market rate rental units currently listed through a source like Zillow aren’t quite apples to apples to all reported rents in the ACS—largely because when landlords list a unit anew that’s a common opportunity to raise the rent more than they do for longer-standing tenants. Also, longer-standing tenants in cheaper units are less likely to turn over, all things equal.” This point is well taken: It does not appear possible, using only the data from the Census, to make a rigorous inference from the minimum rents in Zillow’s database of currently offered market rate rents to the minimum rents being paid by existing tenants in market rate apartments. The ACS data could allow us to quantify the two dynamics that Luc points to, but the ACS data cannot allow us to quantify those dynamics differentially for market and subsidized units. So, even with the Zillow data, it seems impossible to exclude the possibility that some of the very low rent units that the ACS reports could be market rate units with long term tenants.

How does this ACS count compare to the Navigator and administrative data? We can use ELIL occupancy rates from the administrative data to develop a count of ELIL-occupied subsidized units. These units are renting at or below 30% of the ELIL threshold as detailed in the table below. Rewritten August 2025: As shown in the last two lines, this estimate differs substantially from the ACS based count developed by the NLIHC. One can reconcile the difference by making plausible assumptions about a share of mobile voucher holders reporting their contract rent instead of their tenant payment, but these assumptions are too tenuous to support a confident reconciliation.

Table 4: Prediction of American Community Survey Count of Units Affordable and Available to ELIL Households from Agency Data (Affordable and Available roughly equivalent to ELI Occupied at ELIL Affordable Rent)*

| Units | %ELI Occupied at ELIL Affordable Rent* | Count ELI Occupied at ELIL Affordable Rent* | |

|---|---|---|---|

| (1) State public housing | 41,500 | 78% | 32,370 |

| (2) Federal Public Housing | 29,957 | 78% | 23,366 |

| (3) Federal Mod Rehab | 1,662 | 87% | 1,446 |

| (4) Federal Project Based Section 8 Rental Assistance | 59,394 | 79% | 46,921 |

| (5) 202/PRAC (Federal Supportive Housing for the Elderly) | 3,752 | 80% | 3,002 |

| (6) 811/PRAC (Federal Supportive Housing for Persons with Disabilities) | 967 | 94% | 909 |

| (9) Other Fixed Below Market Units | 51,872 | 0% | – |

| (10) Federal Housing Choice Vouchers | 99,530 | 78% | 71,000 |

| (11) State vouchers MRVP/AHVP | 11,000 | 78% | 8,580 |

| (12) Total Agency Predicted Count (2023-4)* | 187,594 | ||

| (13) National Low Income Housing Coalition Count From American Community Survey (2022) | 145,391 |

Line Notes to Table Above

For the first column in most lines, see the first comparison table. These notes explain the second column.

- We do not have an ELIL occupancy rate for state public housing. We are assuming the same ELIL occupancy as for federal housing. This is reasonable as they have similar average income levels (22,963/24,212, fed/state) and similar mixes of family vs elderly/disabled tenants (68%/69% state/fed household count). See the attached spreadsheet

- Using rates supplied from HUD Program Data as of December 31, 2023.

- Same source as 2.

- Same source as 2.

- Same source as 2.

- Same source as 2.

- Consolidated to line 10, August 2025

- Consolidated to line 10, August 2025

- “Other Fixed Below Market Units” include some (25,860) tax credit units that have no rental assistance (i.e, no PBRA, no HCV project based, or no HCV tenant based). Perhaps 10 or 15% of all Massachusetts tax credit projects do rent at the ELIL level, or at least that is the current target. But many of have these have project-based vouchers and so have already been counted on line 8. Among non tax-credit projects in the “Other Fixed Below Market Units” category — 40B, Inclusionary Zoning, and other projects not subsidized by HLC — few are likely to be affordable at the ELIL level. For lack of a finer number, we round this line to 0% affordable at the ELIL level.

- Revised August 2025. Now reflects all Housing Choice Vouchers, whether tenant-based or project-based and comes directly from same source as 2. Previously, lines 7 and 8 used incomplete federal LIHTC data to estimate allocations of project and tenant based HCVs to tax credit units and line 10 was the remaining HCV’s. Old line 10 was further reduced based on the misconception that some HCV’s could be attached as a revenue enhancement to public housing units. There is further implicit assumption that all HCV voucher holders are paying rent that is affordable to them. This is not likely 100% accurate.

- State voucher count from HLC. Assuming (for lack of better data) same ELI share as federal vouchers, at best a ballpark assumption. Old line 11 only counted half of the vouchers apparently assuming that the PBVs were dupes of other projects — this assumption may be incorrect.

- This is the total count of units that we expect would show to the ACS as occupied by ELIL households at ELIL affordable rent levels. These counts are ambiguous as to vacancy rates, but there are long waiting lists for most of these units, so vacancy rates are very low. Reflects corrections made to line 10. There is an implicit assumption here that all HCV voucher holders are paying rent that is affordable to them. This is not likely 100% accurate.

- This is the total count of units that show in the ACS as available to ELIL households at ELIL affordable rent levels, based on analysis from the National Low Income Housing Coalition. These counts include units occupied by ELIL households at affordable rents and vacant units with rents that would be affordable to ELIL households.

NOTE August 2025: Two sections offering thoughts on rent burden and on VLI household have been superseded and have been removed from this post.

Conclusion

The robustly developed affordable housing counts from the Housing Navigator are roughly consistent with agency data. As to the Census data, this much stands after the corrections made to this post on November 30, 2024 and in August 2025: The Census data do not contradict the Navigator and agency data.

Resource spreadsheet here.