This post collects information about the use of tax exempt bonds to reduce the costs of housing development.

Basics

In general, interest on debt issued by state government or any political subdivision of a state government is exempt from federal income taxation. Tax exempt bonds carry lower interest rates than taxable bonds because investors make their investment decisions to achieve the maximum return after taxes. This saves costs for tax exempt borrowers.

Private activity bonds — state or local bonds where the funds are passed through to support a private business use — are not tax exempt, unless they are “qualified bonds”. “Qualified bonds” include the following types of bonds:

26 USC 141(e)

- an exempt facility bond,

- a qualified mortgage bond,

- a qualified veterans’ mortgage bond,

- a qualified small issue bond (not available for family residential),

- a qualified student loan bond,

- a qualified redevelopment bond, or

- a qualified 501(c)(3) bond.

For the purpose of housing finance, all of these bond types are of use– except the student loan type and the small issue type. Some projects could be financed under more than one category of exemption and public reporting of tax-exempt activity does not generally classify volume by exemption category. See this IRS overview of tax exempt private activity bonds.

Qualified residential projects as exempt facilities

The term exempt facility includes “qualified residential rental projects” which are defined as follows:

The term “qualified residential rental project” means any project for residential rental property if, at all times during the qualified project period, such project meets the requirements of subparagraph (A) or (B), whichever is elected by the issuer at the time of the issuance of the issue with respect to such project:

(A)20–50 test The project meets the requirements of this subparagraph if 20 percent or more of the residential units in such project are occupied by individuals whose income is 50 percent or less of area median gross income.

(B)40–60 test The project meets the requirements of this subparagraph if 40 percent or more of the residential units in such project are occupied by individuals whose income is 60 percent or less of area median gross income.

26 U.S.C 142(d)(1)

The qualified project period is 15 years — longer if the tax-exempt financing is still outstanding or the project is still receiving project-based section 8 assistance.

This eligibility test is looser than the similar test for project eligibility for the low income housing tax credit in that it does not directly require that the rents on the apartments be restricted to affordable levels, only that the occupants meet the income tests. In practice, projects with tax-exempt financing often also seek tax credits. (Income is defined according to Section 8 rules.) If some units in the project do have rent restrictions, the project has greater flexibility as incomes of existing tenants rise — this is known as “deep rent skewing.“

Another important distinction between the eligibility rules for tax-exempt finance and the eligibility for tax credits is the qualified basis: In tax exempt financing, the whole project is eligible for financing if includes the requisite mix of low-income units. But for tax credits, only the costs allocated to the low income units are eligible for the credit.

Mortgage bonds

Mortgage bonds issued by a state housing finance agency pass through the lower cost of tax-exempt financing to moderate income home buyers. To be a tax exempt mortgage bond:

- Proceeds must be used to finance single family residences

- Purchase price does not exceed 90% of average area purchase price

- Buyer’s income is less than 115% of applicable median family income (Section 8 AMI, higher of area or state with adjustments for housing prices)

- At least 20% of funds are used for purchases in targeted areas — i.e., in lower income areas and areas of chronic economic distress

- The mortgage is a new mortgage as opposed a refinancing

- The income and purchase prices limits do not apply to certain mortgage bonds for veterans. Veterans’ mortgage bonds are also exempted from the bond-issuance volume cap described below.

Redevelopment bonds

Using redevelopment bonds, state and local agencies can use tax-exempt bonds to fund projects to redevelop “blighted” areas.

- Redevelopment must be undertaken to a redevelopment plan authorized under a state redevelopment statute — for example, in Massachusetts, Chapter 23G.

- Redevelopment bonds are not pass-throughs like mortgage and housing project bonds — they must be secured by tax revenues (or an expected increment in tax revenues

- “Blighted areas” are area determined by local government (subject to size rules) “on the basis of the substantial presence of factors such as excessive vacant land on which structures were previously located, abandoned or vacant buildings, substandard structures, vacancies, and delinquencies in payment of real property taxes.”

- Allowed uses of proceeds exclude new construction, but include:

- the acquisition by a governmental unit of real property located in such area,

- the clearing and preparation for redevelopment of land in such area which was acquired by such governmental unit,

- the rehabilitation of real property located in such area which was acquired by such governmental unit, and

- the relocation of occupants of such real property.

- Certain specific projects are excluded, among them “private or commercial golf course, country club, massage parlor, hot tub facility, suntan facility, racetrack or other facility used for gambling, or any store the principal business of which is the sale of alcoholic beverages for consumption off premises.”

501(c)(3) bonds

501(c)(3) bonds — bonds that are pass-throughs to non-profit entities. Allowed pass-through purposes notably include hospital financing, but also do include residential rental projects in the following categories.

- For the elderly or disabled, as opposed to family units

- For new construction or substantial rehabilitation of family units

- For projects that would qualify under the exempt residential facilities category

501(c)(3) bonds must be used for the purpose of the non-profit — they cannot finance unrelated trades or businesses. 501(c)(3) bonds are not subject to the volume cap discussed below. See also this overview of history and issues related to 501(c)(3) bonds and this IRS overview document.

A consequence of the exclusion of 501(c)(3) bonds from the tax-exempt bond volume cap is that any tax credits associated with them are included in the tax credit ceiling. This makes 501(c)(3) pass-through financing unattractive for affordable housing development: Affordable housing generally needs tax credits. If the 4% credit is enough for the project, then the credit awarding agency is going to want the developer to use a financing approach which does not lead to the credit counting against the tax credit ceiling. More about the credit ceiling here.

Volume cap

Private activity borrowing in each state is limited by a volume cap which is computed on a per capita basis. The chart below details the volume cap computation for Massachusetts for recent years.

Massachusetts tax exempt financing volume cap

| Calendar Year | (1) MA Population | (2) National volume cap per capita | (1) x (2) = (3) MA volume cap |

|---|---|---|---|

| 2020 | 6,892,503 | $105 | $723,712,815 |

| 2021 | 6,893,574 | $110 | $758,293,140 |

| 2022 | 6,984,723 | $110 | $768,319,530 |

| 2023 | 6,981,974 | $120 | $837,836,880 |

| 2024 | 7,001,399 | $125 | $875,174,875 |

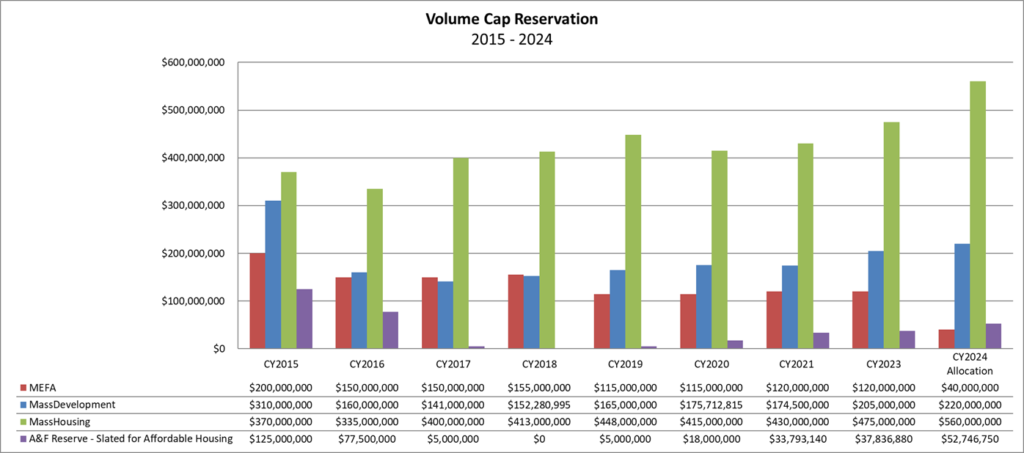

In Massachusetts, the Secretary of Administration and Finance (“A&F”) has the authority to allocate available volume cap to different purposes. The chart below shows the allocation of the volume cap in Massachusetts for the past ten years. According to A&F, in 2023, 82% of allocated volume cap went to housing — or $687 million. That would imply that 85% of MassDevelopment’s allocation went to housing ($174 million, derived by backing out the MassHousing and A&F Reserve allocations from the housing total). There was a substantial volume cap reallocation from education to housing purposes in 2024, resulting in an increase in the housing allocation of approximately $110 million.

Massachusetts volume cap allocation — 2015-2024

Massachusetts tax-exempt finance agencies

MassHousing

As shown in the chart above, roughly 2/3 of the state’s tax-exempt bonds that are subject to the volume cap go out through MassHousing. Formally known as the Massachusetts Housing Finance Agency, MassHousing was established by Chapter 708 of the Acts of 1966 as an independent agency. The MHFA authorizing language includes a statement of necessity that evokes the struggles of the 1960s but still resonates today:

It is hereby declared that as a result of public actions involving highways, public facilities and urban renewal programs, and as a result of the spread of slum conditions and blight to formerly sound neighborhoods, there now exists in many cities and towns in the commonwealth an acute shortage of decent, safe and sanitary housing available at low rentals which persons and families of low income, elderly persons and veterans who will be returning from Vietnam can afford. This shortage is inimical to the safety, health, morals and welfare of the residents of the commonwealth and the sound growth of the communities therein.

Chapter 708 of the Acts of 1966, Section 2

As originally constituted 1966, the MHFA was focused exclusively on lending to support the production of low income rental housing.

The MHFA may make mortgage loans to sponsors of such multi-dwelling housing projects as in the judgment of the MHFA have promise of supplying well planned, well designed apartment units which will provide housing for low income persons or families in locations where there is a need for such housing. Such loans may include construction loans as well as permanent loans.

Chapter 708 of the Acts of 1966, Section 5

The legislation specified eligibility definitions for low income rental housing eligible that have been superseded today by HUD definitions. The authorizing legislation has been amended and substantially rewritten repeatedly, notably to expand into moderate-income home-ownership lending. The following list may not identify all relevant legislation and does not fully characterize the effects of the identified legislation.

| Chapter 263 of the Acts of 1979 | Organizational changes — board membership |

| Chapter 789 of the Acts of 1981 | Mortgage loans for rehabilitation |

| Chapter 264 of the Acts of 1982 | Rewrite, expand powers into residential mortgage lending |

| Chapter 151 of the Acts of 1996 | Organizational changes |

| Chapter 204 of the Acts of 1996 | Organizational changes |

| Chapter 239 of the Acts of 1998 | Rewrite, increase focus on persons with disabilities; allow income eligibility by federal standards |

| Chapter 23 of the Acts of 2003 | Increase bond ceiling |

| Chapter 150 of the Acts of 2004 | Organizational changes, regulatory exemptions, increase bond ceiling |

Today, MassHousing is a complex banking organization benefiting from multiple funding sources, and implementing multiple programs. Notably, the Commonwealth is relying on it to manage a number of housing-related grant programs (see Note O, page 80 of 2024 Annual Report). At its core, however, MassHousing continues its original mission to finance affordable rental housing projects and its extended mission to directly assist moderate income home buyers. These twin missions correspond to the two permissible purposes for tax-exempt financing discussed above. According to its recently filed 2024 Annual Report:

Our Multifamily business line closed 30 transactions totaling $648.4 million, supporting the creation and preservation of 3,263 rental housing units, 92% of which (3,006 units) are affordable. As of June 30, 2024, we serviced 1,758 multifamily loans with an outstanding balance of $7.4 billion.

In our Home Ownership business line, we helped 2,315 Massachusetts residents buy their first home by providing $401.9 million in first mortgage financing. . . .

Mass Housing 2024 Annual Report, Message from the Chair and Chief Executive Officer

Mass Housing lists financial documents here. Mass Housing offers an overview of tax-exempt financing availability here.

MassDevelopment

MassDevelopment is a complex agency that deploys funds from multiple sources for diverse economic development purposes, many of which have no relation to housing. However, its authorizing statute, Chapter 23G, does contemplate housing development in blighted areas, consistent with the redevelopment category of tax exempt financing:

- Section 8 allows mixed commercial and residential development in blighted areas.

- Section 16 generally authorizes redevelopment of blighted areas pursuant to a redevelopment plan (as required by the tax code), which may be a plan that specifies residential uses, including affordable housing. The agency’s annual report is oriented toward illustrating major projects and many of these do include housing in blighted areas.

Additionally, and perhaps in much greater volume, the agency provides conduit tax-exempt financing for affordable rental housing developments. This financing goes to both for-profit and non-profit borrowers and appears to gain its tax-exemption under the general affordable rental category (not likely from 501(c)(3) category). Conduit bonds are not obligations of the agency. See 2023 financial statement at page 41.

Related agencies

The following housing agencies work closely with the tax-exempt financing agencies:

- Executive Office of Housing and Livable Communities provides general leadership on housing policy and works closely with both tax-exempt financing agencies to award tax credits in conjunction with tax-exempt financing.

- Massachusetts Housing Partnership provides technical assistance to communities and organizations seeking to build affordable housing. It administers the Massachusetts Housing Partnership Fund created by Section 35 of Chapter 405 of the Acts of 1985, a fund which receives certain charges on banks. Most significantly, it makes below-market taxable housing loans in partnership with banks.

- Community Economic Development Assistance Corporation was chartered by statute to provide early stage financing and technical assistance to non-profit developers including community development corporations. Additionally, it assists in the distribution of funding for housing for people with disabilities.