Two events this week were good news for local schools.

First, the Senate Ways and Means Committee released a draft budget which further increases the major aid programs that benefit local schools. The Senate draft builds on the House budget approved in April, which was already very strong for local schools.

Each of the communities that I represent — Watertown, Boston and Belmont — will benefit in different ways.

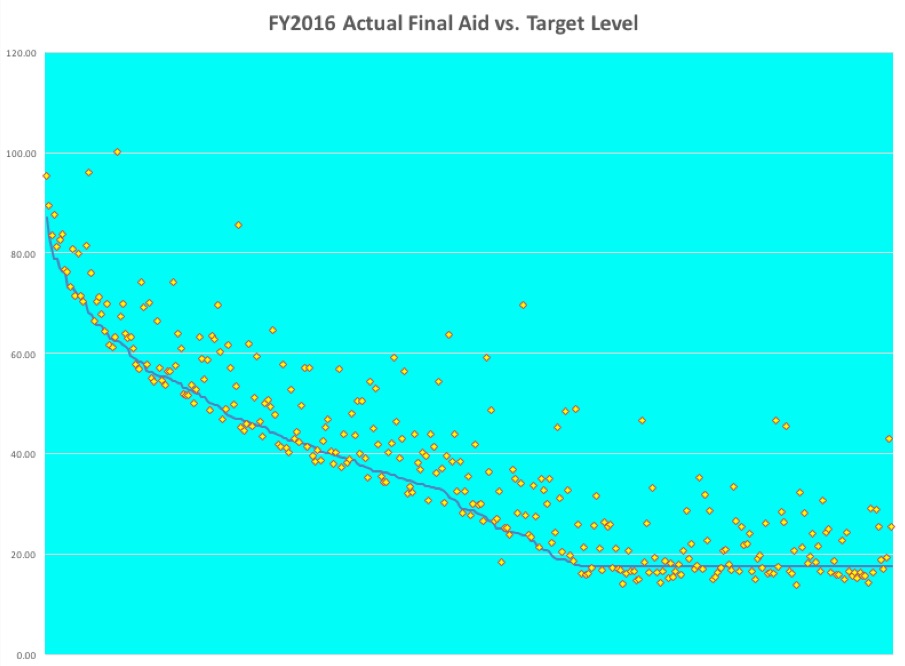

Watertown will benefit from the Senate’s decision to finally meet the 2006 aid reform commitment to provide at least 17.5% of each district’s “foundation budget” through the Chapter 70 (school aid) program. Belmont and Boston have been at this level for several years and I’ve been concerned to bring Watertown up to the same level. There was never any policy justification for Watertown being at a lower level; the disparity was the unintended result of an overly complex mathematical formula. The graphic above (from an advocacy document I prepared then) shows the many other communities that were receiving aid below their target level in FY16 — with the senate budget, no community should fall below the target line.

Boston will benefit from a roughly 25% increase in the statewide program that cushions the state-aid consequences of students departing to charter schools. When a student from a school district elects to attend a charter school, the district must pay to the charter an amount equal to the district’s total per-pupil average cost. In Boston, because it has relatively high per pupil spending, that rule is a significant factor attracting charter schools. The charter charge is deducted from chapter 70 aid, so that Boston has seen its net state aid go down over the past few years. The state has a program designed to cushion that loss by reimbursing districts for the first few years of charter charges, but has not fully funded that program. Together with other Boston legislators, I have pushed for full funding. The 25% increase will help considerably, although it will still leave the program less than fully funded.

All three communities will benefit from an increase in the special education “circuit breaker”. This is the program that reimburses districts for the very high costs that they may incur when they need to place a student with special needs in an out-of-district program. Some such programs run into the hundreds of thousands of dollars per year and the state reimburses a portion of those costs through the circuit breaker. Dollar-for-dollar, this is one of the state-wide programs that benefits my communities most directly. The senate budget fully funds this program so that the state should be able to reimburse 75% of excess out-of-district costs. See this post for more explanation with Belmont as an example.

In the long run, all three communities will benefit from efforts to increase the “foundation budget“. The foundation budget is a fundamental concept underlying the chapter 70 state aid formula. It is a computed number intended to reflect the necessary costs of educating the specific students that a district has. It starts with the number of students enrolled, but includes various adjustments to reflect the costs of educating special education students, English language learners and students from economically disadvantaged backgrounds. It also includes adjustments for the rising costs of fringe benefits.

Over the past few years, a consensus has developed that the foundation budget is inadequate. A Foundation Budget Review Commission recommended increases. The legislature has been unable to act on those recommendations because they would be too expensive. Chapter 70 aid is computed as a share of the foundation budget. (The share varies for each community according to its wealth.)

The senate budget begins to implement the FBRC recommendations. The adjustments are not great enough to outweigh other factors in the aid computations for the communities that I represent, but as the adjustments progress to appropriate levels over the next few years, we can expect to see some benefit.

Following the budget release, the second major action this week was a senate vote to create a process to systematically review the foundation budget commitments each year to assure that we continue to make progress towards a more realistic budget.

These are not radical changes, but they do offer meaningful help for local schools. Of equal importance, they signal a commitment to further progress. Over the next couple of months we can hope that they will all be finally approved by both branches and by the Governor.

Good news for our communities Will!

Happy to hear it!

Good work!

I understand school communities in Belmont, Watertown and Boston are facing progressive population pressure with increased school enrollment. These school numbers reflect the demographics of the general population. In the face of expanding / building more facilities, I sincerely hope that appropriate programming trumps architecture and optional benefits that imperial basic needs. We need surveillance of childrens’ emotional growth and interventions to address identified problems acutely with the long term goal of stability and productive lives.

Emotional growth is so important, but doesn’t show in our metrics!

Will — I very much appreciate the attention to fully funding the special education circuit breaker and hope that the state will continue to fulfill this important commitment in all future years as well.

Helen

Thank you for the explanation and your effort! It is difficult to decode – and this certainly gives some clarity! Annissa Essaibi-George, Boston City Councilor At-Large & Chair of the Education Committee.

Thanks for all you do, Annissa!

Can you elaborate on the chatter I have heard about the state owing Boston money for education? I wish I could explain my question further. I am under the impression that the there is some outstanding state funding at the present time.

This probably refers to the underfunding of the charter reimbursement program. The state has a schedule of intended reimbursements as discussed in the piece above that it typically does not meet. There are many programs that are “subject to appropriation” and do not go forward as intended unless the state has adequate funds. This year’s proposal is a big step to more fully fund that program.

I hope this funding shift is permanent and reoccurring and not just a one time deal. I have concern about who is going to pay for this. The property tax payers previously got shafted in these deals with unfunded mandates, I would want it to come from the income tax. I am paying 26% of my adjusted gross income on a fixed income in property taxes. Can we align the beneficiaries with the burden?

The income tax is the biggest source of state revenue. But no, we can’t align the beneficiaries with the burden — the wealthiest communities pay the most income tax, but the poorest get the most education aid. Education aid is designed to equalize educational opportunity.

Hopefully, this signals the end of the charter school movement in Massachusetts.

Wow….the FBRC has accomplished a great deal this spring. Thank you for providing the links to the background data and the results of the policy discussions. I am disappointed that the reimbursements to BPS remain at 25%. It seems that the policymakers were eager to please the foundation members as opposed to providing adequate funding for the staff and supplies in the public schools that educate and nurture the children of the cities of the state. Thank you for participating in the arduous process and the contentious votes.

The charter funding actually increased by 25%. That’s a pretty big and helpful jump for Boston.