A full accounting of the costs and benefits of electrification requires consideration of the following second order consequences (in addition to the other benefit-cost components identified in the heat pump outline):

- Added heat pump electric loads will require new transmission and distribution capacity and may affect grid reliability.

- Added heat pump electric loads may drive up electric prices — the opposite of the “demand reduction induced price effect (DRIPE)” associated with energy efficiency measures.

- Reduced fossil fuel heating load may drive down gas and oil prices — a “demand reduction induced price effect (DRIPE)” in those markets.

Estimating these effects requires deep examination of the regional energy systems and complex modeling. The Avoided Energy Supply Cost Study (AESC) offers some estimates. The AESC was developed by Synapse Economics for the purpose of supporting benefit-cost analysis by energy agencies in New England.

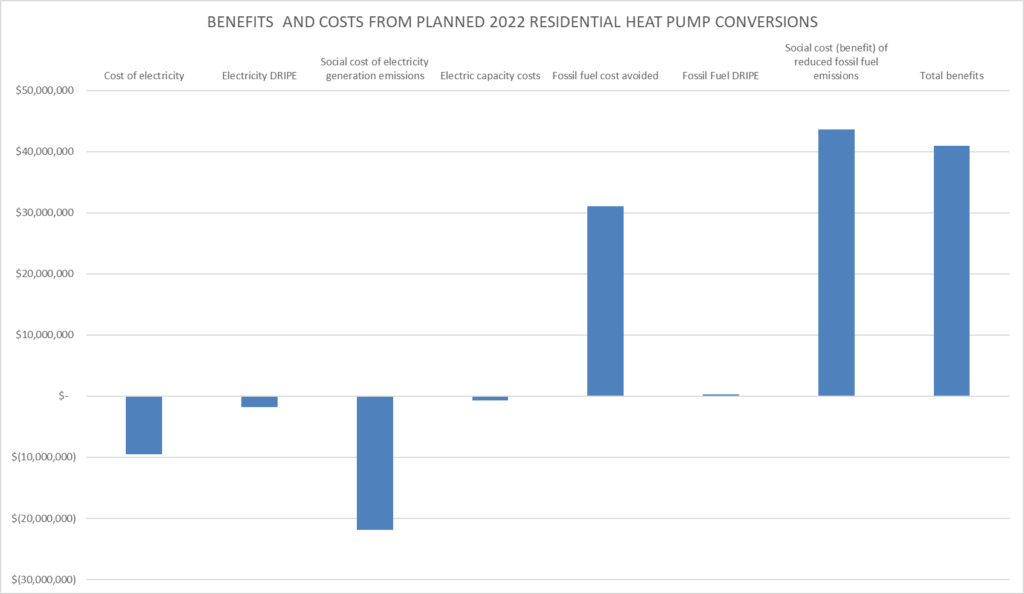

The benefit-cost models submitted by the Mass Save plan administrators in support of their three year plans all rely on the AESC. The chart below, based on those submissions, suggests that the second order effects are material, but much smaller than the primary benefits and costs — net energy and net carbon benefits. Note that in the chart, electric costs are negative because they are a cost; fossil fuel costs are positive because they are a benefit.

NOTE: This chart is derived from the CalcsYR1 tab of Exhibit 5 in the original November 2021 three year plan submissions for Eversource (Docket 21-129) and National Grid (Docket 21-124). It includes the eight basic residential heat pump conversion measures in the two plans (EA2c266, EA2c272, EA2c268, EA2c273, GA2c070, GA2c071, GA2c072, GA2c073) — gas/oil x full/partial x ducted/ductless. The chart aggregates the costs and benefits for all of the measures in the quantities for each that are specified in the plans. In this chart based on the November 2021 submissions, the social cost of carbon is $393/MTon.

Given the wide uncertainty on many other variables, this chart suggests that it is acceptable to think of DRIPE and capacity costs as negligible over the time frame modeled by the AESC — early 2020s through late 2030s, the life time of heat pumps installed in the early 2020s.

In the long run, price effects and capacity costs — transmission, distribution, reliability — will become more significant. For the period directly modeled in the AESC (through 2035), the New England grid is still a summer peaking system, so price spikes and capacity costs are driven by summer loads, not by the winter loads created by heat pumps. In the benefit-cost models, the capacity computations are all based on summer loads — see columns CU through DI in the calcsyr_ tabs in Exhibit 5 of the original November 2021 three year plan submissions for Eversource (Docket 21-129) and National Grid (Docket 21-124). In the long run, we know that winter heat pump peak loads are likely to drive new price spikes and additional grid upgrades and those do not emerge in the current modeling.

Have these models drilled down to the individual home/building electrical infrastructure? As someone that has interacted with residential customers on daily basis for nearly 40 years I have to wonder. So many homes simply do not have the electrical panel capacity to accept any additional demand. Models don’t see this, but heating contractors do. Upgrading electrical service to 200A is a fairly significant cost, and currently not reimbursable by incentive programs. In my experience, this situation has created a dead end on customer’s ability to add air conditioning – be it conventional or heat pump. The usual outcome is to continue to use a window air conditioner and current mode of traditional heating. It seems these models are viewing at 20,000′ and not seeing the real challenges at ground level. I’m also curious why solar is not part of this equation. While it doesn’t eliminate the electrical service issue entirely, it does offer a no money down option that will provide a net reduction in electrical cost to the customer, which in turn would show a return via savings in heating cost (which doesn’t seem to be the case currently).