This page was last updated on 4/14 and will be updated as more information becomes available.

Enacted on March 27, the federal Coronavirus Aid, Relief and Economic Security (CARES) Act includes nontaxable, direct cash payments to individuals, which are referred to as “2020 recovery rebates” in the new law and “economic impact payments” by the Internal Revenue Service (IRS).

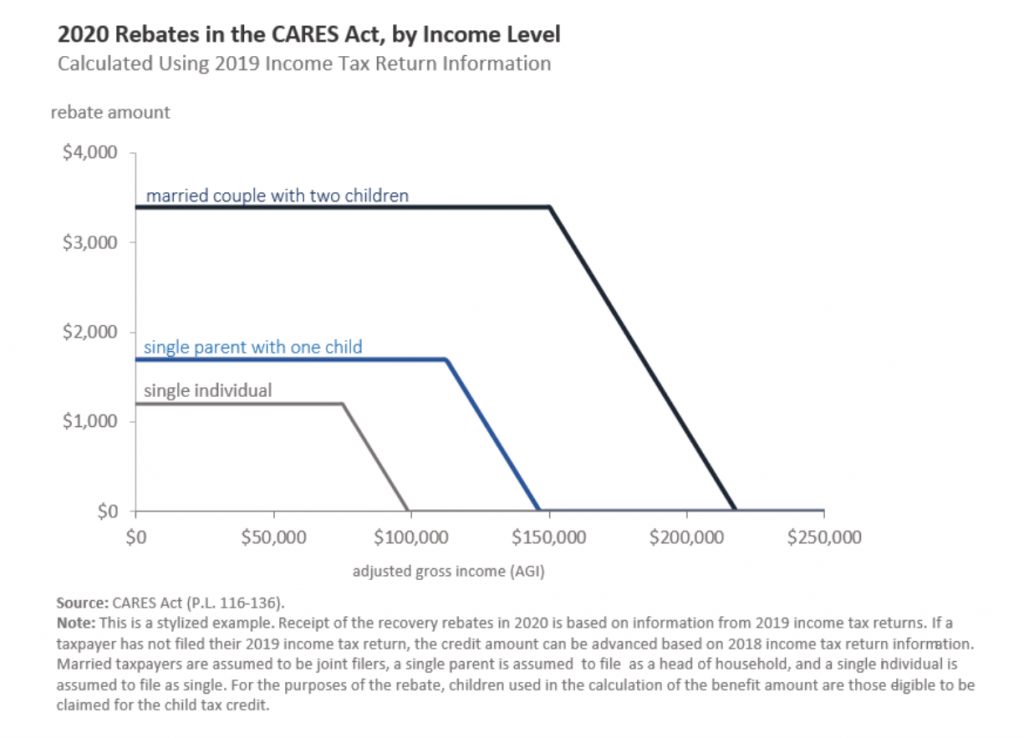

The Washington Post estimates that up to 83% of taxpayers will receive a payment, which will amount to $1,200 per individual ($2,400 for married taxpayers filing a joint tax return) and $500 per child under the age of 17. Individual taxpayers with an adjusted gross income (AGI) of up to $75,000 ($150,000 for married taxpayers filing jointly) will receive the full payment, while the amount will be reduced for higher earners and phased out at a rate of 5% of AGI above $75,000.

The payment amount will be based on an individual’s total income reported in their 2019 or 2018 federal tax filing, and will be distributed to most individuals automatically by the IRS, either through direct deposit or paper check by mail. While there is no concrete timeline for distribution, the IRS expects to start sending payments to most Americans in April 2020.

Recipients of Social Security and Railroad Retirement are eligible to receive economic impact payments, even if neither a 2019 nor a 2018 income tax return was filed. In these cases, the IRS will use information from an individual’s 2019 Social Security or Railroad Retirement Benefit Statement (SSA-1099 or RRB-1099) to estimate the payment amount.

Other individuals who did not file taxes in 2018 and have not yet this year are strongly encouraged to file their 2019 federal tax return before the extended July 15 deadline in order to qualify for the economic impact payment.

To expedite payment distribution, the US Treasury has developed an online portal for individuals who have not yet authorized direct deposit for tax refunds to provide their banking information to the IRS online.

Those ineligible for the 2020 recovery rebate include:

- Single filers with an AGI above $99,000

- Head of household filers with an AGI above $146,500

- Joint filers without children with an AGI above $198,000

- Individuals without a Social Security Number

- Individuals who can be claimed as a dependent by another taxpayer

- May include full-time college students under the age of 24

- Estates and trusts