Background: Moratorium Expiration, Eviction “Tsunami”

At the pandemic’s outset, renters and homeowners were protected by an evictions and foreclosures moratorium enacted in April, but evictions are predicted to soar as unemployment benefits and housing relief measures lapse. The moratorium has not absolved tenants or homeowners from paying rents or mortgages, but has protected them from evictions/foreclosures due to nonpayment if they’re able to demonstrate their inability to pay was due to a hardship caused by the pandemic. However, expanded unemployment benefits provided by the CARES Act expired at the of July, and the statewide evictions and foreclosure moratorium – which Governor Baker initially extended to mid-August before continuing the program through October 17 – just ended.

The Numbers

Although the exact numbers of impacted residents and the associated relief necessary to address a possible evictions crisis are difficult to extract, a report analyzing the financial impacts of the pandemic prepared by the Metropolitan Area Planning Council (MAPC) found that:

- Unemployment claims in MA are higher than they have been since the Great Depression, with an estimated 21% of renter families across the state unable to afford housing costs.

- In the first five days of the City of Boston’s COVID-19 Emergency Rental Assistance Fund opening, 5,500 Boston renters applied, indicating the magnitude of need for housing assistance.

- If all workers who were laid off during the pandemic are still out of work when the expanded federal unemployment assistance expires at the end of July, MAPC estimates that 133,300 households in MA will need housing assistance totaling $144.3 million/month to avoid eviction or foreclosure.

- The Pew Research Center has estimated that undocumented immigrants – who are ineligible for both unemployment insurance and CARES Act benefits – make up 5.1% of the Massachusetts workforce. MAPC estimates that there are over 30,700 undocumented workers who were laid off in the first month of the pandemic, who will collectively require approximately $22.3 million in housing assistance per month in order to avoid eviction or foreclosure.

MassINC estimates that between April and June, 29% of MA renters missed paying at least some rent, compared to 13% of homeowners, and forecasts increasing financial hardship the longer the crisis continues. Among renters, only 21% of respondents indicated it would be “very likely” they will be able to catch up on housing payments by the moratorium’s initial expiration date in August.

Short-Term Relief: The Emergency Rental & Mortgage Assistance Program

On June 30, the Baker Administration announced a new $20 million statewide fund to assist low-income households facing difficulty making rent and mortgage payments. The Emergency Rental and Mortgage Assistance (ERMA) program provides direct funding to eligible households who have experienced financial hardship because of the pandemic.

ERMA provides rental and mortgage assistance to low-income households that do not qualify for the state’s existing Residential Assistance for Families in Transition (RAFT) program. To be eligible for RAFT, households must fall within the 30-50% range of the Area Median Income (AMI), while ERMA adjusts this income threshold to serve households within the 50-80% AMI range.

Like RAFT, ERMA provides up to $4,000 for eligible households to pay outstanding rent or mortgage payments dating back to April 1, 2020; funds became available for distribution through the state’s 11 Housing Consumer Education Centers on July 1.

The Residential Assistance for Families in Transition Program

In response to the increased need for housing assistance fueled by the pandemic, the Department of Housing & Community Development (DHCD) authorized a series of changes to make RAFT more accessible and effective, including allowing applicants to apply based on their future inability to pay rent.

Designed as a homelessness prevention program for households with very low incomes experiencing a housing crisis, RAFT has historically provided eligible households up to $4,000 in emergency assistance to retain existing housing, obtain new housing, or otherwise prevent homelessness. RAFT is funded through the DHCD and is distributed by 11 regional administering agencies.

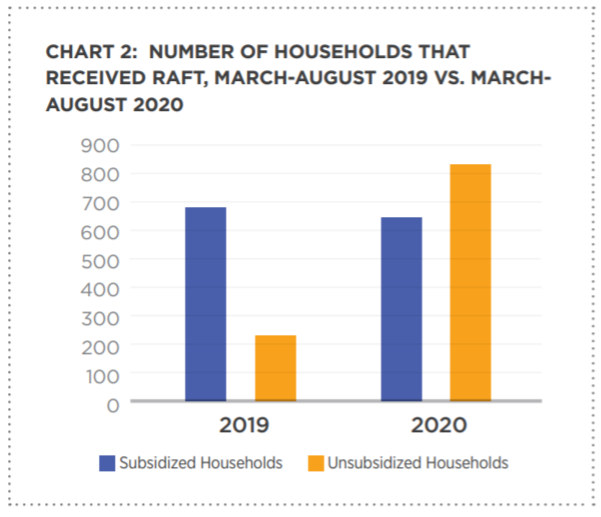

Demand for housing assistance has dramatically increased since the beginning of the pandemic. An October report by MetroHousing Boston found that the number of households receiving RAFT benefits increased 62% between March and August 2020 compared to the same period in 2019, with average payments increasing by 19% and total payments increasing by 94%.

Importantly, these increases were driven by a change in the type of households seeking relief. Between March and August 2020, the number of households receiving RAFT without any other type of housing assistance, such as a Section 8 voucher, grew by 276% compared to the same period in 2019, as illustrated by the graph below.

MetroHousing Boston analyzed the incomes of households that have received RAFT assistance since March 2020, revealing a stark difference in how the pandemic has impacted households with and without subsidized housing. Households without subsidized housing that received RAFT assistance through August 2020 had a median annual income 81% higher than the median annual income of households that receive other housing subsidies. It is MetroHousing’s position that the pandemic has had a negligible effect on the need for RAFT assistance among households with subsidized housing. The report concludes:

“This is strong evidence that income supports and subsidized housing, combined with modest emergency housing assistance through RAFT, are highly effective in ensuring housing stability for households with extremely low incomes.

In the short-term, the Commonwealth needs to either increase the availability of income supports for extremely low income households, or significantly increase the $4,000 limit on RAFT assistance over a 12-month period for income-eligible households that do not have subsidized housing.

In the longer-term, extremely low income households need long-term housing subsidies for housing stability. The Commonwealth should increase funding for the Massachusetts Rental Voucher program and step up its efforts to add to the supply of rental units affordable to ELI households.”

Housing advocates paint a similar picture: while the state has worked to address the affordable housing gap with crucial and successful short-term solutions, a different approach is needed to prevent the wave of expected evictions if pandemic-related financial hardships persist.

Housing advocates have identified several avenues for program improvement:

Program Limitations | While RAFT funds can be used flexibly, a significant drawback of the program is that relief had been limited to $4,000 per 12 months. As we move further into the pandemic, residents will require additional assistance. Housing advocates have been successful in working with the Baker Administration to allow certain RAFT applicants to receive up to $10,000 per calendar year, as part of the Governor’s new Eviction Diversion Initiative discussed below.

Administrative Burdens | RAFT is administered through regional housing agencies across the state, which have been slow to process and approve applications due to the sheer volume they’ve received since March. Some agencies have seen increases of up to 400% in their number of applicants while continuing to operate at the same pre-pandemic staffing levels. In addition to the volume of applications agencies are working on, slow processing times have been attributed to the burdensome application process. While DHCD has worked to make RAFT more accessible and effective during the pandemic, documentation requirements and submission processes continue to create access barriers. A coalition of housing advocates have been working with DHCD to further streamline this process.

Funding | Additional funding is necessary for both the front- and back-ends of the administration process. Regional housing authorities need additional funding to increase staffing levels to better handle the influx of pandemic-related applications, while the program itself requires additional funding to address the staggering demand for program relief.

To address these needs and in the wake of the October 17 expiration of the evictions moratorium, the Baker Administration announced on October 12 the creation of the Eviction Diversion Initiative, a $171 million plan to support tenants and landlords experiencing financial hardship during the pandemic. The initiative provides:

- $100M to expand the capacity of the RAFT program

- $48.7M to HomeBASE and other rapid rehousing programs

- $12.3M to provide tenants and landlords with access to legal representation and related services prior to and during the eviction process

- $6.5M for Housing Consumer Education Centers

- $3.8M for the Tenancy Preservation Program to provide case management support

The Eviction Diversion Initiative further builds on the the RAFT program updates instituted earlier this year by DHCD to improve turnaround times in application processing by:

- Streamlining the application processes for RAFT and ERMA

- Verifying applicant eligibility using data collected through MassHealth, the Department of Transitional Assistance, the Department of Unemployment Assistance, and the Department of Revenue

- Allowing landlords who own fewer than 20 units to apply directly for RAFT and ERMA with tenant consent

For additional information and local resources related to housing relief, please visit the Senator’s page on “Emergency Housing Assistance for Renters, Homeowners, and Landlords”