What does research tell us about the changing distribution of income at the top?

The income tax data about concentration of top income

Paul Krugman’s blog offers many entry points into the academic literature of inequality. He has helped make the professionally-acclaimed work of economists Thomas Piketty and Emmanuel Saez more visible in Washington. Their policy prescription — sharply increased tax rates for the rich — is controversial, but their factual contribution is not. They analyzed income tax data to produce a century long view of rising inequality in the United States. They recently updated their statistical tables through 2010. All table and figure references below are to the update.

According to the Piketty-Saez numbers, the income share of the top 1% declined through the Great Depression and the post-war years and reached its lowest level in the century in 1973, at 7.74%. See Piketty-Saez, Table A1 (note that capital gains are excluded in this table to reduce volatility — in table A3, which includes capital gains, the 1% share was lowest in 1976).

From 1973 through 2010, real income grew most for the top earners (data below excerpted from Piketty-Saez, Tables A4, A7, A8). The Piketty-Saez data do a good job of measuring income trends for income tax filers. They don’t fully account for the lower end of the income distribution, but the basic statement seems clear. The chart shows (in the 3rd line), that the bottom 90% lost ground while the top earners saw their real incomes grow dramatically. The wealthiest grew most — income for the top 0.01% grew 600%. (The column heads indicate the percentile group of tax filers — so that, for example, P99-99.5 means tax filers in the bottom half of the top 1%.)

| Income fractile of tax unit | P0-90 | P90-95 | P95-99 | P99-99.5 | P99.5-99.9 | P99.9-99.99 | P99.99-100 |

|---|---|---|---|---|---|---|---|

| 1973 average income in 2010 dollars | $33,199 | $98,942 | $140,621 | $234,265 | $349,031 | $677,724 | $2,171,328 |

| 2010 average income | $29,399 | $124,023 | $200,005 | $398,410 | $722,401 | $2,295,992 | $16,267,243 |

| % Change of Average Income, 1973 to 2010 (Inflation-adjusted) | -11.4% | 25.3% | 42.2% | 70.1% | 107.0% | 238.8% | 649.2% |

| $ Bottom Edge of Fractile in 2010 | 0 | $107,006 | $147,909 | $335,861 | $487,686 | $1,304,205 | $5,884,420 |

| Wage Share of non-capital-gains Income in 2010 | n/a | 91.0% | 84.6% | 77.7% | 61.5% | 48.7% | 33.6% |

| Entrepreneurial Share of non-capital-gains Income in 2010 | n/a | 5.6% | 10.7% | 16.1% | 28.9% | 36.7% | 36.5% |

| Capital Gains income as share of total income -- 10 year average, 2001-2010 | n/a | 3.2% | 5.1% | 7.9% | 12.4% | 17.9% | 19.8% |

The income share of the top 1% has doubled. It was under 10% through the 1970s, but has averaged 20% since 2000. The income share for the top 1% of the top 1%, in other words, P99.99-100, or the 0.01%, has quadrupled — it averaged under 1% in the 1970s, but has averaged 4.5% since 2000 — a level not seen since the 1920s. (Piketty-Saez, Table A3).

An interesting point emerging from the data in the chart is that by contrast to the early 20th century, when the very wealthy derived their income primarily from returns on capital, the very wealthy in the early 21st century rely more heavily on returns from labor — wages and business income. For more on this, see Piketty-Saez, Figure 4B.

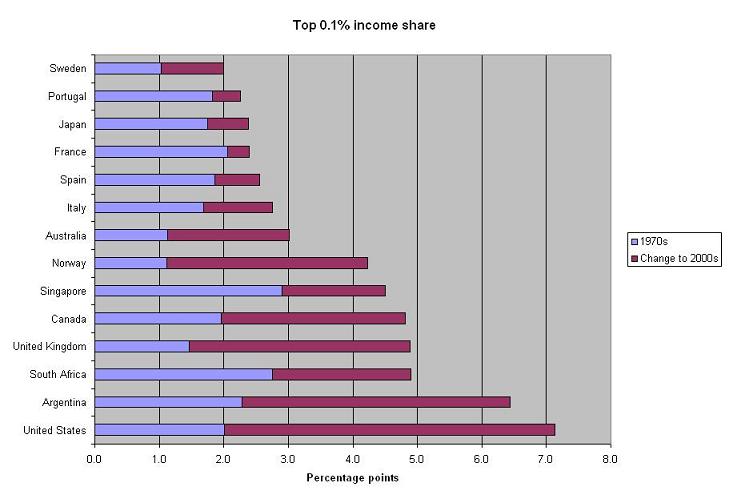

Piketty and Saez have participated in an international comparative project using tax returns to compare top income distributions across countries. The chart below is based on a download from the database and includes all the countries for which the database includes income share data from both the 70s and the 2000s (with the exception of tiny Mauritius, which showed a slight decrease in top income share). The years available are not consistent across countries and the chart shows the average of available years in the two decades compared.

The chart shows that top income share has been increasing in many developed countries, but that suggests that the phenomenon is most dramatic in the United States. Compare a similar factoid from Krugman here.

Who are the top income earners?

While the conversation about inequality has tended to focus on Wall Street executives, about half of those crossing the 1% level in 2005 were doctors, lawyers, engineers, professors, athletes, artists and other non-managerial workers. See table 2a of Bakija, Cole and Heim’s recent study of tax returns. 31.0% were non-financial executives, managers or supervisors. Only 13.9% were financial professionals, although this share had risen from 7.7% in 1979.

Zooming in further, business executives and financial professionals are more heavily represented in the top 0.1% and accounted for roughly 70% of the income received within the top 0.1% (which in turn was 7.34% of all national income). Of course, if one zooms in three more decimal places to the Forbes 400 (roughly the .0003%), they are almost all executives and investors (many of whom started as entrepreneurs).

Theories about the concentration of top income

The basic split in the conversation about the causes of pre-tax top income concentration is whether to see it as a result of globalization and automation, consistent with the general depression of middle class income, or whether there is some other dynamic at work — possibly a power dynamic or a tax policy dynamic. Krugman has been harshly critical of those who would see top income concentration has a simple result of increasing returns to education in the new economy. Bakija, Cole and Heim emphasize the Piketty-Saez finding that top incomes now are largely return to labor and seek explanations for the increased concentration consistent with that reality. They softly discount, as primary explanation of the increased income concentration in the United States, theories that globalization and technology change create new opportunities for extraordinarily talented people to sell the their skills — in a global market their skills may be scarcer, new technology they may leverage them, or the superstars among them may be able to drive out lesser talents in a highly connected world. They point out that these theories should probably apply equally across the developed world, but top incomes have not risen as sharply in continental Europe and Japan (although their could be multiple explanations for this). Additionally, these theories are easiest to intuit for artists and others that are among the smaller occupational categories within the one percent.

Additionally, they reject the supply-side theory that falling marginal tax rates for the very wealthy in the United States stimulated the surge in top income. Their data show widely varying trajectories of income growth by occupation and income within the one percent (financial and real estate professionals growing more rapidly and generally the highest earners growing more rapidly). Yet the tax rate reductions apply more or less equally to all the groups. They also point out that a supply-side analysis of top income growth is arguably inconsistent with rising top income in the 90s when rates increased and also arguably inconsistent with lack of a top income response to rate cuts in Japan, although there are many factors at work.

They do feel that that falling individual tax rates caused taxpayers to choose to recognize individual income directly through S-corporations rather than leaving income in C-corporate treasuries. This phenomenon, though “particularly important” is not the whole story of top-income rise though because top income shares continued to rise even after the rate rise in 1993 and most of the apparent ownership changes in the data occurred before 1993.

They are drawn to the theory that executive compensation practices may be changing, perhaps especially in financial professions. They note the close correlation of top earner compensation with stock market fluctuation and conclude that

Most of our evidence points towards a particularly important role for financial market asset prices, shifting of income between the corporate and personal tax bases, and possibly corporate governance and entrepreneurship, in explaining the dramatic rise in top income shares.

I find this explanation broadly plausible. Executives, leading professionals and financial engineers have been able to capture more of the profit stream. But, to my mind this does come back indirectly to technology and globalization — it seems consistent with the emerging pattern of corporations having a thinner core of mission-focused employees with many corporate functions spread out over a dynamically changing global supply chain. Top talent now has greater bargaining power versus both firm owners and firm employees. They can more easily recreate a business in a new form — in the financial context, for example, they are more able to recruit leverage on their own and more able create the support systems of a firm (market data, trading and settlement systems) from outsourced components. Similarly, the new online retailers, from Amazon to Nasty Gal, are building wide customer bases using the internet instead of capital-intensive store fronts. In the law firm context, the handful of rain makers have less need for an army of second-tier attorneys and staff to support them. Of course, it still isn’t clear what regulatory or institutional or other factors make the change more dramatic in the United States and Great Britain.

For another summary of theories, see the Congressional Budget Office report on inequality at pages 18-19. See also, this NBER working paper which suggests that deregulation of the financial sector contributed to increasing skill requirements and corresponding compensation in financial services.

Note that the analysis above pertains to pre-tax market income. According to the recent Congressional Budget Office analysis, the net effect of taxation changes over the past few decades in the United States has been to further widen disparities in after-tax income. If tax policy reinforces top income concentration, whatever its causes, we may indeed be headed back to oligarchy.

Thanks for this very thoughtful and comprehensive discussion of a crucial topic. I am impressed. I would just like to say that while I agree that the main problem seems to be that the super-elites “have been able to capture more of the profit stream”, this is not necessarily, or at least not primarily, because these elites are “top talent” that have more “bargaining power.” You seem to be suggesting a “winner-take-all society” theory, in which CEOs and the financial sector are not making more money because they are like Tom Brady or Jay-Z and they are playing to ever-larger audiences, whereas I suspect that it is more a matter of rent-seeking, and, basically, capture of the political and regulatory institutions of our country. The FIRE share of our GDP has more than doubled since the sixties, I think, without, according to people like Paul Volcker, adding anything of benefit to our society besides the ATM.

I should also say that Precinct 3 Belmont Resident seems to be fairly misguided, especially when he or she writes, “No sober economist can create a believable scenario where we can keep entitlement programs intact and stay solvent as a nation.” This is simply absurd, given that the US is richer than ever, that our projected long-term “entitlement” deficit is essentially a problem of ever-rising health care costs, and that many other countries (Canada, Germany, Sweden, etc.) have quite generous entitlement programs, higher taxes, and are staying solvent, all having significantly less government debt than the US.

Thank you.

I think there may be more than one dynamic operating at the same time.

Regarding the entitlements, I think that is a separate conversation from the conversation about taxation levels for the wealthy — we have a deficit in the short and medium term and the entitlements will only be addressed in the very long term. It may get all balled up in one deal, but they are really distinct problems.

Having lived in Sweden, it was quite clear that since over 90% of employees/managers are unionized there is a voice for the people that balances with that of company owners. Also everyone gets free health care, access to free education, retraining, and much more thanks to very generous “entitlements” and boy was it nice knowing that everyone would be caught by the safety net!