As an investment in affordable housing production, the state’s low income housing tax credit (“LIHTC”) is now larger than our recently expanded bond funded capital program. The legislature doubled the credit in 2020 and increased it again by 50% in 2023. It now delivers $240 million annually in subsidy for affordable housing development. The annual cost of the tax expenditure is approaching $300 million annually.

State LIHTC Basics

Unlike typical tax credits that can be claimed by any taxpayer who meets eligibility criteria, state LIHTC credits are affirmatively awarded through a competitive process administered by the Executive Office of Housing and Livable Communities (“HLC”). The awards are made as part of a “one-stop shopping” model that includes the awards of direct subsidies and the federal LIHTC. The credits are awarded to developers who are often non-profits. The developers generally sell the credits to third party corporate taxpayers at some discount to reflect (a) the time value of money; (b) the costs of marketing; (c) the costs of monitoring the compliance with credit terms (the use of tax credits adds investor oversight of the rental limits required for eligibility for the tax credits); and (d) fundamental demand for Massachusetts tax credits. Housing and Livable Communities estimates that these factors together result in state LIHTC being sold for roughly 80 cents on the dollar.

In Massachusetts, the same Qualified Allocation Program (required by both state and federal law) governs the administration of both the state and federal LIHTC credit programs. In fact, our state LIHTC statute incorporates federal standards and requirements by reference.

[Housing and Livable Communities] shall authorize, administer, determine eligibility for the Massachusetts low-income housing tax credit and allocate the credit in accordance with the standards and requirements as set forth in section 42 of the 1986 Internal Revenue Code, as amended and in effect for the taxable year; . . .

Massachusetts General Laws, Chapter 63, Section 31H(b)(2)

To comply with federal law, projects may minimally qualify in one of three ways — see 26 U.S.C. 42(g):

- 20% of the units are affordable (i.e. rent less than 30% of income) for households making 50% or less of the area median income

- 40% of the units are affordable for households making 60% or less of area median income

- A 40% selection of units have affordability levels that average to 60% or less of area median income — for example:

- 10% of units affordable at 40% AMI,

- 20% affordable at 60% AMI, and

- 10% affordable at 80% of AMI

Massachusetts applies stricter eligibility standards to ration its available credits (state and federal) to benefit the lowest income households. It has narrowed the definition of the third federal eligibility approach and has deepened the affordability requirements to reserve a percentage for extremely low income persons (under 30% AMI). See Qualified Allocation Program, Section IV and Threshold #11. Additionally Massachusetts requires a 30-year affordability period for federal credits and 45-year affordability period for state credits. Qualified Allocation Program, Section IV and Threshold #9.

LIHTC contribution to affordable housing production

HLC estimates that the state LIHTC’s FY25-29 contribution to affordable development resources will be $1.2 billion. The UMass Donahue Institute relied on this estimate in its evaluation of the impact of the Affordable Homes Act. This estimate appears reasonable and consistent with prior tax expenditure estimates.

To understand the estimate, one needs first to understand the history of upwards revision of the statutory cap on awards of the state low income housing tax credit.

History of state LIHTC cap revisions

| Acts instituting and adjusting the state LIHTC* | Tax Years | Cap** |

|---|---|---|

| Chapter 127, Acts of 1999, Sections 82, 90 (first instituted with sunset after 2005) | 2001-2005 | $4m |

| Chapter 290, Acts of 2004, Section 6, 10 (extend credit through tax year 2010) | 2006-2008 | $4m |

| Chapter 119, Acts of 2008, Sections 4, 5 (approved May 2008, raised cap, removed sunset) | 2008-2012 | $10m |

| Chapter 142, Acts of 2011, Sections 11, 15 (raise cap with sunset, s. 100) | 2013-2014 | $20m |

| Chapter 129, Acts of 2013, Section 14 (extend raised cap sunset) | 2015-2019 | $20m |

| Chapter 99 of Acts of 2018, Section 24 (extend raised cap sunset) | 2020 | $20m |

| Chapter 358 of Acts of 2020, Sections 58, 60, 86 (further raise cap with sunset, s. 112) | 2021-2022 | $40m |

| Chapter 50 of Acts of 2023, Sections 23, 30, 41, 49 (further raise cap, remove sunset) | 2023 on | $60m |

** Adjustments may be made for prior year unused credits and credits returned by taxpayers. From 2001 to 2008, a cap formula including comparison to the federal LIHTC was used -“the lesser of 50 per cent of the federal per capita tax credits awarded to the commonwealth pursuant to section 42 of the 1986 Internal Revenue Code, as amended and in effect for the taxable year, or $4,000,000.”

The second key understanding is that while the credit “cap” refers to amount of new credits that can be issued in each year, each newly issued credit may be then taken annually in the issued amount for each of five years. In other words, before discounting for resale, a $1 million credit is worth $5 million. After selling the $1 million credit at 80 cents on the dollar (typical market discount, see above) the developer has $4 million in funding for their affordable project.

The recently adjusted $60 million cap level applies across the five fiscal years FY25 through FY29 for which we are estimating available developer resources. Each year’s $60 million allocation translates into $60 million in credits received annually in each of five years. Five times $60 million equals a total of $300 million in tax credit value. In turn, over five years of annual allocation, this adds up to a total of $1.5 billion in tax credit value (5 x 5 x $60 million). The HLC five-year estimate of $1.2 billion in equity value to be realized from tax credit sales by developers in FY25-29 reflects discounting at the rate of 80% off the total tax expenditure of $1.5 billion. The same computation yields an equity value of the credit of $0.8 billion for FY20-24 and $0.4 billion for FY2015-19. See attached spreadsheet.

LIHTC tax expenditure estimate

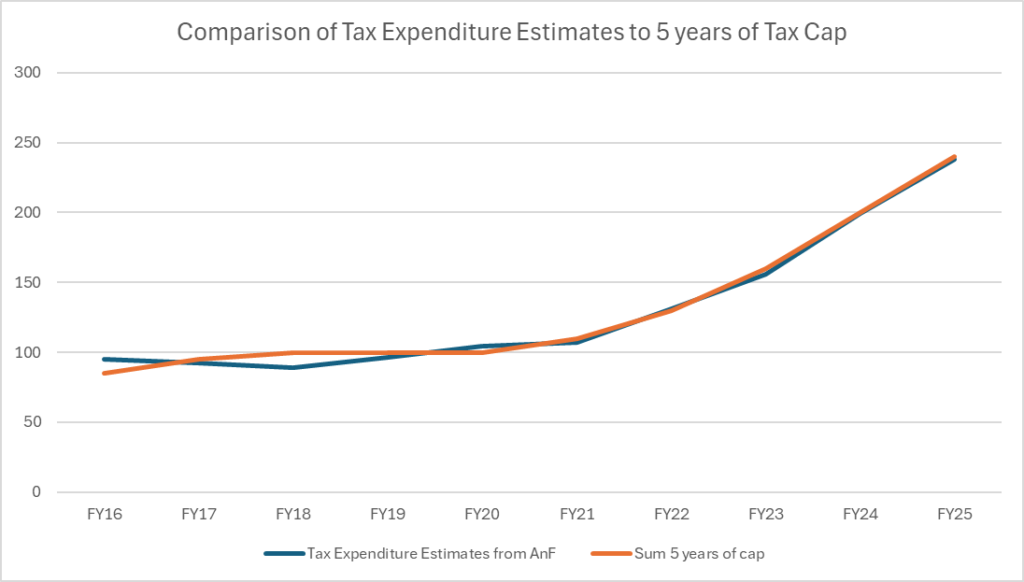

Subject to timing issues as to when developments are placed in service, the cost of the credit as a tax expenditure should be roughly equal to the sum of the tax caps for the five prior years (assuming that all available credits are allocated). The chart below shows how closely these two quantities track together. The chart compares: (1) the LIHTC tax expenditures reported by the state’s Administration and Finance agency; (2) the sum of tax caps from the prior five years. This close correlation tends to confirm that almost all of the available tax cap gets allocated.

Administration and Finance tax expenditures estimates for state LIHTC compared to sum of five years LIHTC cap — individual and corporate combined

Conclusion

The state LIHTC is a huge contributor to affordable housing development and official estimates of both its affordable housing contribution and its budget impact appear accurate.

I’m delighted to see LIHTC programs receive more support. After a devastating household breakup many years ago, an LIHTC unit kept me from being homeless. LIHTC is great.