We provide this press release from the Senate President’s office highlighting the increases in the minimum wage and the earned income tax credit to take effect on January 1, 2016. Several articles on the minimum wage and the EITC are also provided.

FOR IMMEDIATE RELEASE

Working Families Get a Raise from Senate-Led Initiatives

Increases in Minimum Wage and Earned Income Tax Credit Set to Take Effect in 2016

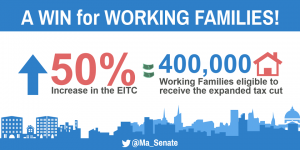

BOSTON — Over 450,000 hardworking families across Massachusetts will soon receive a raise when the state minimum wage increases to $10 an hour and the state Earned Income Tax Credit expands by over 50%.

“We live in a Commonwealth, which means that everyone must share in the prosperity of our vibrant economy, not just those at the top. The Senate has made shared prosperity a guiding principle of our work. By increasing the minimum wage and expanding the Earned Income Tax Credit, we will put money into the pockets of working families, and grow our economy from the bottom up instead of the top down. I am proud of the Senate’s leadership in securing these reforms, which speak volumes about the kind of place we want Massachusetts to be,” said Senate President Stan Rosenberg (D-Amherst).

The minimum wage increase to $10 an hour will raise the average earnings of a minimum wage worker by about $2,000 a year. According to estimates, this increase will reduce the number of Massachusetts residents living below the federal poverty level by about 3%.

The Senate passed the minimum wage increase in November 2013, with the House following suit in April 2014. Governor Patrick signed the final legislation in July 2014.

The Earned Income Tax Credit (EITC) expansion will provide up to $500 in additional income to working families with at least three children. Families receiving the EITC have higher long-range earning potential and increased social security benefits. Children in EITC households have increased academic scores and high-school graduation rates.

The expansion of the Earned Income Tax Credit was proposed by the Senate in May 2015, with final passage in July 2015.

###

Boston Globe: Twin Boosts for Low-income workers on Jan.1

Boston Globe: Op-Ed from Senate President Rosenberg on EITC

Mass Budget: Effects of a $10 Minimum Wage

Mass Budget: Massachusetts EITC

Mass Budget: EITC & Min Wage Together

Happy new year!

I fully support a raise of minimal wages for the working families. Let the people that work hard ( especially in the private sector) live a better life and have a smaller tax burden.

On the other hand, please plug the holes in the corruption laden MBTA system. Look at how much they have been making while enjoy a life time of job security and benefits?

Isn’t corruptions in the public sector ( MBTA as an obvious example) why all working families struggle?

Quoted from another forum contributor

” WCBV highlighted an example of a rail maintenance employee who made $315,000 (yes, $315k – not a typo), including 2,600 hours (!) of overtime pay. Something is seriously wrong when it’s possible for a T rail maintenance worker to be paid twice the average MA primary care physician salary. (Never mind how anyone could possible earn a legitimate 2,600 hours of overtime.) “